Can exports rescue ethanol?

As the Renewable Fuels Association’s National Ethanol Conference convened in Dallas last month, the outlook for ethanol appeared grim. The Environmental Protection Agency still hasn’t issued set the Renewable Fuel Standard for 2014, and ethanol manufacturers have been left in limbo.

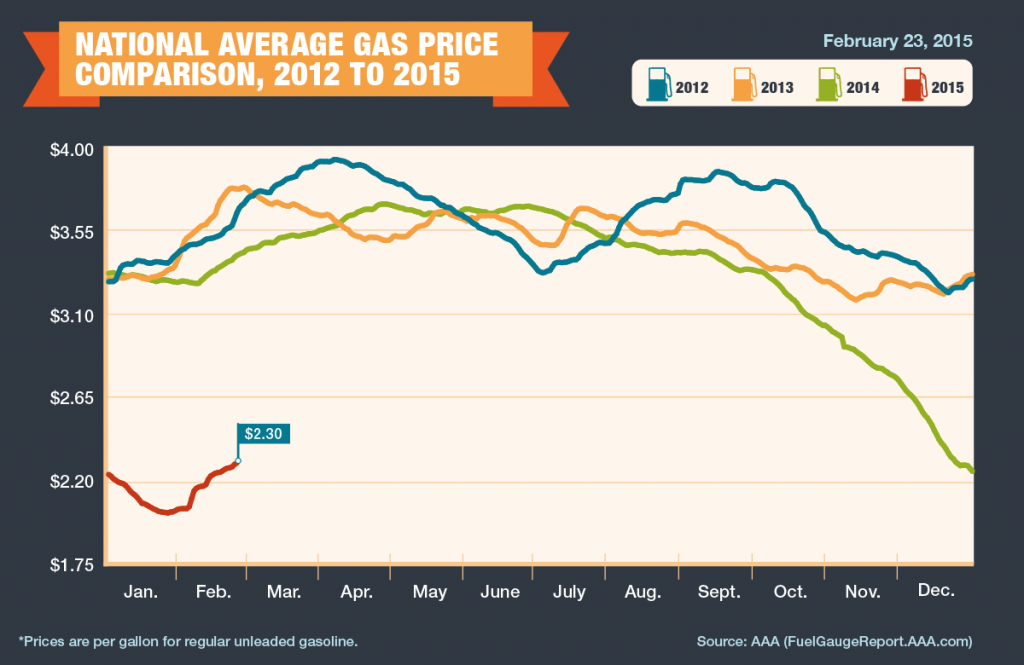

On top of that, ethanol producers still are dealing with the months-long drop in oil prices. Even though Brent crude has been rising again of late, hovering around $60, it’s a far cry from the $115 it traded at last June. The overall price swoon has driven down ethanol stocks, along with those of oil companies. Warren Buffett has unloaded his ExxonMobil stock, which seemed to have been a bellwether for the market in general. Yet if the oil-price drop increases the consumption of gasoline and the 10 percent ethanol requirement holds, ethanol sales could actually go up while the price remains the same.

No one really knows what’s going to happen as long as the EPA keeps delaying new guidelines for the RFS, which will mandate the total amount of ethanol that should be sold in the coming year. The problem has been that, as demand for gasoline slackened, and the required amount of ethanol blended into the nation’s gas supply steadily rose, the ethanol threshold approached the 10 percent “blend wall.” Government testing has shown that virtually all vehicles model year 2001 and newer can run safely on ethanol blends up to E15, but the impact on older engines is still unclear. Christopher Grundler, director of the EPA’s Office of Air Quality and Transportation, apologized for the delay and said the EPA might be issuing its decision on the RFS in the next couple of months.

Yet no one at NEC seemed terribly bothered by the delay. Why? Because the ethanol industry is starting to boom with demand from abroad. “Who needs the RFS? Who needs the EPA?” Tim Worledge wrote on The Barrel, a blog of the Platts energy-news service. “We’ve already proven we can make the stuff … now it’s time to take it global.”

Ethanol exports are not limited the way oil exports are, so there’s no restriction on what can be sold abroad. Many countries don’t limit ethanol additives to 10 percent of gasoline, so there’s plenty of room for opportunity. “There are some persuasive arguments around this [the export] solution,” Worledge writes. “Bob Dinneen, the near-legendary head of the RFA [Renewable Fuels Association], cited 61 countries globally that have biofuel mandates in place. Target them. Grow the economy at home and target the locations in the world where opportunities remain — the “explosive growth” of China and India is an opportunity, says Dinneen, while Pedro Paranhos, vice president of Eco-Energy, pointed out that the US has already supplanted many of Brazil’s traditional export markets, with the only markets proving immune are those where quality and feedstock issues give Brazilian outflows an advantage.”

The international market is indeed just beginning to show signs of a demand for American ethanol. “The burgeoning firepower that the US ethanol industry can bring to the global market could yet see further pressure heaped upon the rest of the world’s ethanol products,” Worledge continued. The industry, he said, should be “looking to the world’s markets to insulate yourself from these political uncertainties,” i.e. the EPA’s delays on the RFS.

One potential problem is that the U.S. is trying to crack the European market just as the European Union is beginning to worry about whether biofuel production is really all that good for the environment. The debate is raging right now in the European Parliament. But even if Europe decides to set aside some land as off-limits for growing plants to process into biofuels, such restrictions could actually clear the way for the import of American-made ethanol. That would create a huge market opportunity for the U.S. industry.

One way or another, it seems too early to write off the possibility that ethanol will be able to reduce what the countries of the world must buy from oil-producing nations in order to power their transportation.

But there is good news! Many ethanol producers and advocacy groups, with enough love for America to encompass this past Valentine’s Day and the next (and of course, with concern for profits), have acknowledged that a vibrant, vigorous, loving market for E85 is possible, if E85 costs are at least 20 percent below E10 (regular gasoline) — a percentage necessary to accommodate the fact that E10 gas gets more mileage per gallon than E85. Consumers may soon have a choice at more than a few pumps.

But there is good news! Many ethanol producers and advocacy groups, with enough love for America to encompass this past Valentine’s Day and the next (and of course, with concern for profits), have acknowledged that a vibrant, vigorous, loving market for E85 is possible, if E85 costs are at least 20 percent below E10 (regular gasoline) — a percentage necessary to accommodate the fact that E10 gas gets more mileage per gallon than E85. Consumers may soon have a choice at more than a few pumps.