John Brackett is one of the stars of the Fuel Freedom-produced documentary PUMP, but he’s more than just a pretty mutton-chopped face.

Brackett, an automotive engineer in Colorado who goes by the Twitter handle @Fuelverine, has spent a great deal of time promoting the film, which is now available for pre-order on iTunes.

Brackett specializes in tinkering with gasoline-powered engines — any kind, including vehicles and generators — to make them run on multiple types of fuel. But he’s also on a mission to educate the general public, as well as regulators. Converting one’s car to run on alternative fuels is technically not legal, as is using any fuel not specifically listed in the owner’s manual.

But once the public finds out that replacement fuels like ethanol, methanol and natural gas are not only cheaper but burn cleaner than gasoline, they’ll demand them in the marketplace. And they’ll want to learn how to convert their own cars. As Fuelverine says in PUMP: “That’s the best part about being an American: We don’t like it, we’ll change it.”

Fuel Freedom: Why aren’t all the vehicles rolling off the assembly lines labeled as flex-fuel?

John Brackett: The only reason they were ever flex-fuel in the first place was CAFÉ standards (Corporate Average Fleet Economy). And basically what they said is that, ‘Hey, your 6 miles per gallon Tahoe, since it only burns 15 percent gasoline [running on E85], is a 66 mpg vehicle!’ So your overall average for your fleet went up, and that’s why we only have flex-fuel in the giant V-8s and the V-6s. They very rarely went into the four-cylinders, and when they did, they canceled the model within 1-2 years, or even worse, they made it so you could only buy it if you were a commercial or rental fleet company. The [Chevy] Malibu is my favorite example: They made flex-fuel in 2010 for ’em, but it was only for the commercial or the rental fleets, and you couldn’t buy that four-cylinder from your local dealer. So there was never any incentive for them to actually make it mass-produced, they’re just doing it to hit the CAFÉ credits.

FF: Is it a case of companies only doing something because they have a financial incentive to?

JB: Exactly. I’m not usually a mandate-type person, but the Open Fuel Standard is the right type of mandate to allow competition right now. We just don’t have any options.

FF: What are you most interested in right now?

JB: My main thrust is actually making any engine run off of any fuel. I’ve built generators, I’ve gotten cars running on fuels, I’ve done hydrogen, ethane, methane, propane, butane, ethanol, methanol and gasoline. So my personal interest is being able to tell the computer what to change to run off those other fuels. What blew my mind was that the GM cars, and from what we’re told from several tuners, all the Ford cars since 2005, already have the algorithm in there. They literally turned it off. It’s in there.

FF: Is it possible for a car running on ethanol to get better mileage than gasoline?

JB: Basically, E85 has about 25 to 27 percent less energy in the same volume. So when you drive on the fuel, you would expect to lose that much gas mileage. What we found was that if you were driving on the stock flex-fuel from GM, you lost 25 to 30 percent, exactly what you would expect. When I started doing my tuning, and I would change the spark timing just a little bit – I varied it very small, and I did a lot of runs –and when I treated the fuel as gasoline or with slight advancement in timing, we only lost 5 to 15 percent of our fuel mileage.

Let’s go to what GM has already done: GM has a 2.0-liter, 4-cylinder, turbocharged engine out for the Buick Regal. That engine makes 5 to 15 percent more power on E85 than regular gasoline, while still getting the same fuel mileage. They have obviously tuned that car, so they have no problems doing it. Now, if we go to what is called direct-injection engines, which are definitely in the future … you can get even more efficiency out of it. You get another 15 to 20 percent efficiency increase by going to direct injection.

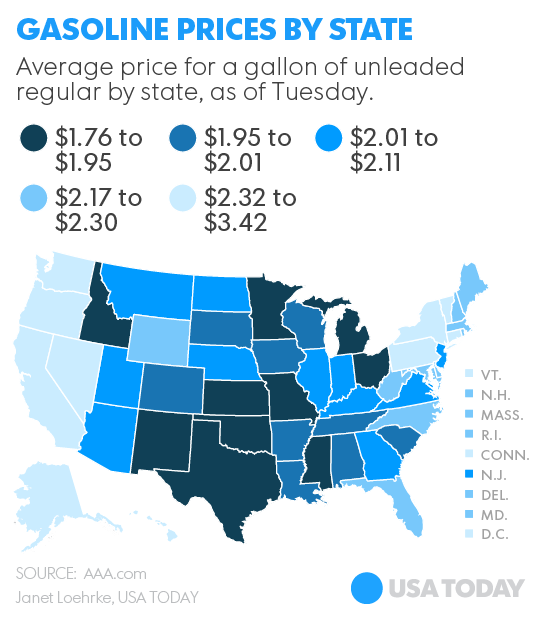

FF: If you look at prices of E85 around the country, there’s a big disparity [for example, it’s $2.09 in Iowa and $2.59 in Arizona, according to E85prices.com]. What will it take to get more consistency?

JB: If you have a bad original flex-fuel tune from a factory, you’re going to lose 30-40 percent [in mileage compared with gasoline]. Nobody wants to do that when it’s only 10 to 20 percent cheaper fuel. That’s one of the big reasons we try to use methanol as a big one, because it is so much cheaper, especially on a dollar-per-mile basis. But the ethanol fight, we just need more cars that have it as an option. Until we have that, you’re not going to have that market saturation. So if you think about where the cars are vs. the market, the numbers don’t add up. And that’s why we need every car to have the option to run a flex-fuel — on gasoline or ethanol or methanol, or any combination of them in the same tank.

FF: A constant refrain among the anti-ethanol crowd is that it damages engines.

JB: The biggest thing I like to tell people is, if you start with the first cars: They were all flex-fuel. They stopped being flex-fuel because of Prohibition. We have the materials, we know how to do this, we’ve been doing this for 30 years. Every car made since 2001 or ’02 has E10-compliant components. All the fuel lines, everything. And if you look at the corrosive nature of ethanol, it happens most between E10 and E30, so it’s actually very small blends of ethanol that cause the worst corrosion. But all the cars should already come to the factory with parts that work for it. There shouldn’t be any problem with it.

FF: Tell me about this conversion kit you’re using, by Flex Fuel U.S.

JB: They have the only E85-approved conversion system right now in the United States. What is different about their unit is it plugs into the oxygen sensor, so it reads the exact feedback from the oxygen system. So if it is lean [too much oxygen and not enough fuel], it should adjust. It plugs in line with the injectors as well, the difference being it doesn’t increase the injector pulse for the stock injectors; they add a whole new injector somewhere in the intake system, and flood the system that way. So they’re actually adding additional injectors to it. I’ve talked to the guy several times. Basically, he has to sell the kits for $1,100 to $1,500 right now, because it cost him $4 million to go through the EPA certification process. And that was only for 8 to 10 models. It’s absolutely ridiculous, the hindrance to competition. But he could easily, at mass scale, sell these for $300 to $500.

… We are now at the point where EPA is stopping us from getting clean air. They’re just making things more expensive.

(Photo: John Brackett dropping some knowledge to the assembled in Times Square, September 2014.)