What does loving America have to do with the whims and opportunity costing of the oil industry?

The Greeks are going broke…slowly! The Russians are bipolar with respect to Ukraine! Rudy Giuliani has asked the columnist Ann Landers (she was once a distant relative of the author) about the meaning of love! President Obama, understandably, finds more pleasure in the holes on a golf course than the deep political holes he must jump over in governing, given the absence of bipartisanship.

But there is good news! Many ethanol producers and advocacy groups, with enough love for America to encompass this past Valentine’s Day and the next (and of course, with concern for profits), have acknowledged that a vibrant, vigorous, loving market for E85 is possible, if E85 costs are at least 20 percent below E10 (regular gasoline) — a percentage necessary to accommodate the fact that E10 gas gets more mileage per gallon than E85. Consumers may soon have a choice at more than a few pumps.

But there is good news! Many ethanol producers and advocacy groups, with enough love for America to encompass this past Valentine’s Day and the next (and of course, with concern for profits), have acknowledged that a vibrant, vigorous, loving market for E85 is possible, if E85 costs are at least 20 percent below E10 (regular gasoline) — a percentage necessary to accommodate the fact that E10 gas gets more mileage per gallon than E85. Consumers may soon have a choice at more than a few pumps.

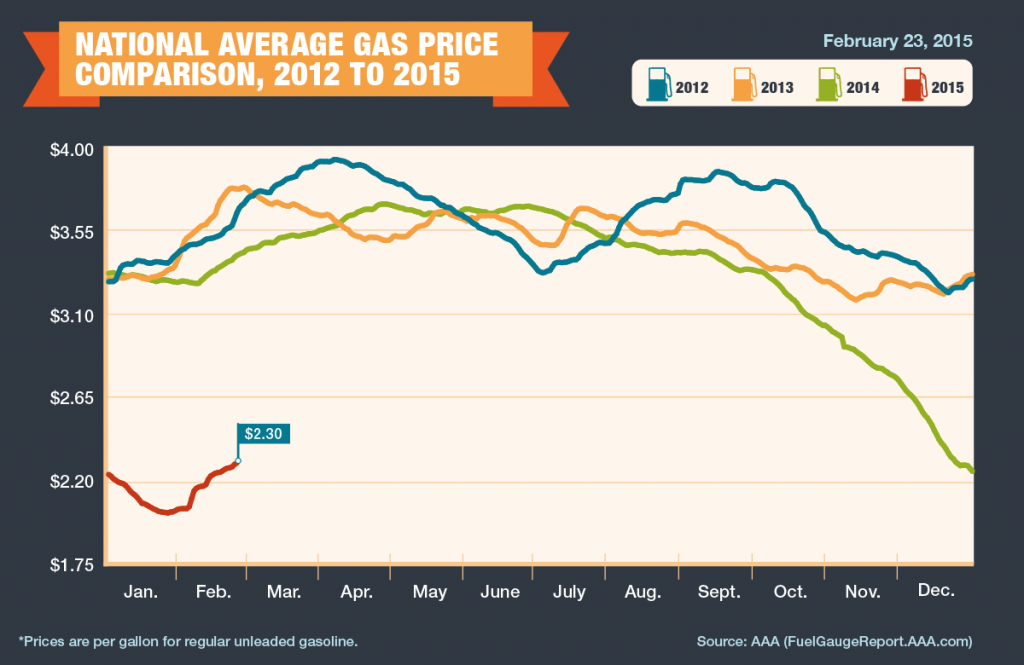

In recent years, the E85 supply chain has been able to come close, in many states, to a competitive cost differential with respect to E10. Indeed, in some states, particularly states with an abundance of corn (for now, ethanol’s principal feedstock), have come close to or exceeded market-based required price differentials. Current low gas prices resulting from the decline of oil costs per barrel have thrown price comparisons between E85 and E10 through a bit of a loop. But the likelihood is that oil and gasoline prices will rise over the next year or two because of cutbacks in the rate of growth of production, tension in the Middle East, growth of consumer demand and changes in currency value. Assuming supply and demand factors follow historical patterns and government policies concerning, the use of RNS credits and blending requirements regarding ethanol are not changed significantly, E85 should become more competitive on paper at least pricewise with gasoline.

Ah! But life is not always easy for diverse ethanol fuel providers — particularly those who yearn to increase production so E85 can go head-to-head with E10 gasoline. Maybe we can help them.

Psychiatrists, sociologists and poll purveyors have not yet subjected us to their profound articles concerning the possible effect of low gas prices on consumers, particularly low-income consumers. Maybe, just maybe, a first-time, large grass-roots consumer-based group composed of citizens who love America will arise from the good vibes and better household budgets caused by lower gas prices. Maybe, just maybe, they will ask continuous questions of their congresspersons, who also love America, querying why fuel prices have to return to the old gasoline-based normal. Similarly, aided by their friendly and smart economists, maybe, just maybe, they will be able to provide data and analysis to show that if alternative lower-cost based fuels compete on an even playing field with gasoline and substitute for gasoline in increasing amounts, fuel prices at the pump will likely reflect a new lower-cost based normal favorable to consumers. It’s time to recognize that weakening the oil industry’s monopolistic conditions now governing the fuel market would go a long way toward facilitating competition and lowering prices for both gasoline and alternative fuels. It, along with some certainty concerning the future of the renewable fuels program, would also stimulate investor interest in sorely needed new fuel stations that would facilitate easier consumer access to ethanol.

Who is for an effective Open Fuel Standard Program? People who love America! It’s the American way! Competition, not greed, is good! Given the oil industry’s ability to significantly influence, if not dominate, the fuel market, it isn’t fair (and maybe even legal) for oil companies to legally require franchisees to sell only their brand of gasoline at the pump or to put onerous requirements on the franchisees should they want to add an E85 pump or even an electric charger. It is also not right (or likely legal) for an oil company and or franchisee to put an arbitrarily high price on E85 in order to drive (excuse the pun) consumers to lower priced gasoline?

Although price is the key barrier, now affecting the competition between E85 and E10, it is not the only one. In this context, ethanol’s supply chain participants, including corn growers, and (hopefully soon) natural gas providers, need to review alternate, efficient and cost-effective ways to produce, blend, distribute and sell their product. More integration, cognizant of competitive price points and consistent with present laws and regulations, including environmental laws and regulations, is important.

The ethanol industry and its supporters have done only a fair to middling job of responding to the oil folks and their supporters who claim that E15 will hurt automobile engines and E85 may negatively affect newer FFVs and older internal combustion engines converted to FFVs. Further, their marketing programs and the marketing programs of flex-fuel advocates have not focused clearly on the benefits of ethanol beyond price. Ethanol is not a perfect fuel but, on most public policy scales, it is better than gasoline. It reflects environmental, economic and security benefits, such as reduced pollutants and GHG emissions, reduced dependency on foreign oil and increased job potential. They are worth touting in a well-thought-out, comprehensive marketing initiative, without the need to use hyperbole.

America and Americans have done well when monopolistic conditions in industrial sectors have lessened or have been ended by law or practice (e.g., food, airlines, communication, etc.). If you love America, don’t leave the transportation and fuel sector to the whims and opportunity costing of the oil industry.