Everyone wants vehicles made in America, so why not fuels too?

Seriously, if we made all our fuel in America we could create not just thousands, but potentially millions of jobs. What gives? Read more →

Seriously, if we made all our fuel in America we could create not just thousands, but potentially millions of jobs. What gives? Read more →

We’re producing more crude and our cars are more efficient, yet we still import millions of barrels of foreign oil per day. What’s going on?

The Greeks are going broke…slowly! The Russians are bipolar with respect to Ukraine! Rudy Giuliani has asked the columnist Ann Landers (she was once a distant relative of the author) about the meaning of love! President Obama, understandably, finds more pleasure in the holes on a golf course than the deep political holes he must jump over in governing, given the absence of bipartisanship.

But there is good news! Many ethanol producers and advocacy groups, with enough love for America to encompass this past Valentine’s Day and the next (and of course, with concern for profits), have acknowledged that a vibrant, vigorous, loving market for E85 is possible, if E85 costs are at least 20 percent below E10 (regular gasoline) — a percentage necessary to accommodate the fact that E10 gas gets more mileage per gallon than E85. Consumers may soon have a choice at more than a few pumps.

But there is good news! Many ethanol producers and advocacy groups, with enough love for America to encompass this past Valentine’s Day and the next (and of course, with concern for profits), have acknowledged that a vibrant, vigorous, loving market for E85 is possible, if E85 costs are at least 20 percent below E10 (regular gasoline) — a percentage necessary to accommodate the fact that E10 gas gets more mileage per gallon than E85. Consumers may soon have a choice at more than a few pumps.

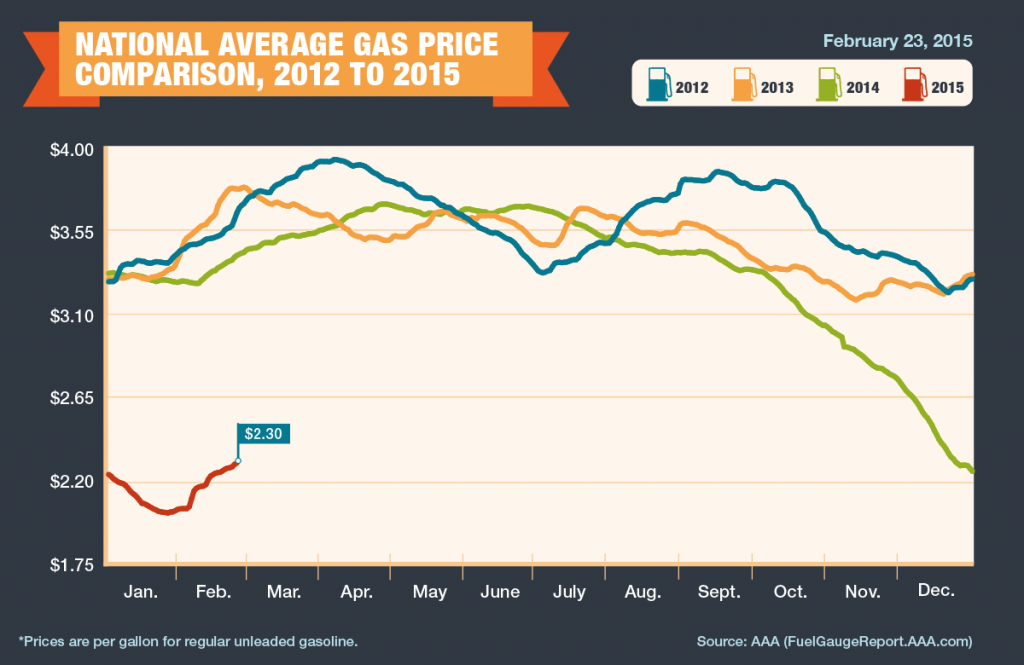

In recent years, the E85 supply chain has been able to come close, in many states, to a competitive cost differential with respect to E10. Indeed, in some states, particularly states with an abundance of corn (for now, ethanol’s principal feedstock), have come close to or exceeded market-based required price differentials. Current low gas prices resulting from the decline of oil costs per barrel have thrown price comparisons between E85 and E10 through a bit of a loop. But the likelihood is that oil and gasoline prices will rise over the next year or two because of cutbacks in the rate of growth of production, tension in the Middle East, growth of consumer demand and changes in currency value. Assuming supply and demand factors follow historical patterns and government policies concerning, the use of RNS credits and blending requirements regarding ethanol are not changed significantly, E85 should become more competitive on paper at least pricewise with gasoline.

Ah! But life is not always easy for diverse ethanol fuel providers — particularly those who yearn to increase production so E85 can go head-to-head with E10 gasoline. Maybe we can help them.

Psychiatrists, sociologists and poll purveyors have not yet subjected us to their profound articles concerning the possible effect of low gas prices on consumers, particularly low-income consumers. Maybe, just maybe, a first-time, large grass-roots consumer-based group composed of citizens who love America will arise from the good vibes and better household budgets caused by lower gas prices. Maybe, just maybe, they will ask continuous questions of their congresspersons, who also love America, querying why fuel prices have to return to the old gasoline-based normal. Similarly, aided by their friendly and smart economists, maybe, just maybe, they will be able to provide data and analysis to show that if alternative lower-cost based fuels compete on an even playing field with gasoline and substitute for gasoline in increasing amounts, fuel prices at the pump will likely reflect a new lower-cost based normal favorable to consumers. It’s time to recognize that weakening the oil industry’s monopolistic conditions now governing the fuel market would go a long way toward facilitating competition and lowering prices for both gasoline and alternative fuels. It, along with some certainty concerning the future of the renewable fuels program, would also stimulate investor interest in sorely needed new fuel stations that would facilitate easier consumer access to ethanol.

Who is for an effective Open Fuel Standard Program? People who love America! It’s the American way! Competition, not greed, is good! Given the oil industry’s ability to significantly influence, if not dominate, the fuel market, it isn’t fair (and maybe even legal) for oil companies to legally require franchisees to sell only their brand of gasoline at the pump or to put onerous requirements on the franchisees should they want to add an E85 pump or even an electric charger. It is also not right (or likely legal) for an oil company and or franchisee to put an arbitrarily high price on E85 in order to drive (excuse the pun) consumers to lower priced gasoline?

Although price is the key barrier, now affecting the competition between E85 and E10, it is not the only one. In this context, ethanol’s supply chain participants, including corn growers, and (hopefully soon) natural gas providers, need to review alternate, efficient and cost-effective ways to produce, blend, distribute and sell their product. More integration, cognizant of competitive price points and consistent with present laws and regulations, including environmental laws and regulations, is important.

The ethanol industry and its supporters have done only a fair to middling job of responding to the oil folks and their supporters who claim that E15 will hurt automobile engines and E85 may negatively affect newer FFVs and older internal combustion engines converted to FFVs. Further, their marketing programs and the marketing programs of flex-fuel advocates have not focused clearly on the benefits of ethanol beyond price. Ethanol is not a perfect fuel but, on most public policy scales, it is better than gasoline. It reflects environmental, economic and security benefits, such as reduced pollutants and GHG emissions, reduced dependency on foreign oil and increased job potential. They are worth touting in a well-thought-out, comprehensive marketing initiative, without the need to use hyperbole.

America and Americans have done well when monopolistic conditions in industrial sectors have lessened or have been ended by law or practice (e.g., food, airlines, communication, etc.). If you love America, don’t leave the transportation and fuel sector to the whims and opportunity costing of the oil industry.

A new documentary film that explores the history of the American fueling infrastructure and how it has led to today’s oil-dominated market, which features some ethanol industry figures, is being well received by critics and viewers alike.

Paul Harvey was a conservative icon in radio news during the mid to end of the 20th century. While I often differed with the substance of his commentary, he was a welcome travel partner when driving, particularly on a long trip. What I liked most about him was that he generally articulated his views without being malicious, and his voice was just wonderful. He sounded like a symphonic rap musician, using iambic pentameter.

One of Harvey’s favorite phrases was here’s “the rest of the story.” Remembering it, gives me a wonderful opening for this column.

This week there were several optimistic articles on natural gas growth this past week . One article in particular caught my eye. The piece described the expanded, but still relatively low, market penetration of natural gas as a transportation fuel. Given the cost and environmental benefits of natural gas, I was pleased to read the content and see the numbers and quotations. But in Paul Harvey’s terms it did not tell “the rest of the story”!

Yes, natural gas is making inroads into the trucking industry, even among buyers of new cars, asserts the article. “The boom in natural gas production in the U.S. has ignited a revolution in the auto sector that could reshape the way Americans fuel their vehicles, market participants and analysts said in a week-long special on FOX Business.” ClearView Energy Partners, the Newport Beach, California company that is building fuel stations along major interstate trucking corridors, will likely facilitate the growth of natural gas as a fuel in trucks. It will provide one of the missing pieces that have impeded natural gas’ popularity — fear of running out of fuel. “About 25% of the truck market could convert to natural gas by 2020, according to a report by Citigroup…eight in 10 new trucks Waste Management brought in 2012 were powered by natural gas.” Your friendly bus driver’s bus is increasingly likely to run on natural gas.

“Only a tenth of a percent of natural gas consumed in U.S. last year was used for fuel in vehicles, according to the Energy Department. Of the more than 15.2 million natural gas vehicles on roads across the globe, [only] about 120,000 are in the U.S.” Natural gas clearly hasn’t taken off yet as a transportation fuel in the U.S. Kevin Book, ClearView’s managing director of research indicates that, “I think you look at locomotives, also a very interesting and potentially large market, and also some of the marine applications before you start talking about smaller passenger cars.” I suspect his negative perceptions of natural gas as a competitive fuel in cars stems from the present costs of CNG passenger vehicles and the present absence of CNG fuel stations — a possible temporary problem if ClearView’s commitment to develop a natural gas highway could extend to private automobiles. We have had many successful freedom movements in this country. There would be only relatively marginal costs to extend the capacity of the natural gas highway’s fuel stations to include CNG availability for all consumers of natural gas vehicles and to assure availability of natural gas derivative fuels like ethanol. If you build it, many of the 17 million FFVs now on the road will come and more will follow, given what’s presently on the (near term) horizon.

Here is more of “the rest of the story,” à la Paul Harvey. One of the most innovative programs to stimulate the use of natural gas, CNG, was initiated by Gov. Hickenlooper and Gov. Fallin. Under their nonpartisan umbrella, 22 states have agreed to replace older cars, when they are due to retire, with CNG cars. Their commitment will create a large pool of CNG purchases over the next few years. Detroit has agreed to work with the states and both the governors and carmakers want to use the effort to produce a less expensive CNG car for American households.

But there is more! Two companies, Coskata, Inc. and Celanese have had success in converting natural gas to ethanol and are both striving to commercialize and define strategies to market their product. If they are successful, other companies will follow in light of historical “copycat capitalism.” The result will be a fuel that will be environmentally better and clearly cheaper than gasoline. The result will also be increased demand for fuels like E85, which will generate consumer purchases of FFVs and the conversion of existing, older cars. It may also open up the pockets of investors concerning the support for future E85 pumps. If ethanol becomes popular because of price and environmental objectives, can methanol be far behind (excuse me, Percy)? Freedom to choose what you drive and what fuel you use on the high and bi ways of this nation would be consistent with the American way and creed.

The ‘60s and early ‘70s were exhilarating at times and depressing at other times. America seemed angry and divided about the Vietnam War, the struggle over civil rights and equal rights for women. Many of those who were against the war and supported civil rights for minorities and equal rights for women were passionate about their views and saw themselves as change agents in an America that they viewed as perfectible but not perfect. They debated, they marched, they shouted, they irritated, and they (at times) exceeded legal boundaries. Some even took personal risks by becoming Freedom Riders in the south. By the early ‘70s, they had made a positive difference. They had become legends in their own time, capped off by Woodstock — an exotic, culture-changing, music rebellion concert. America would never again be the same!

I ask myself why the effort to break up the oil industry’s monopoly at the gas pump has won intellectual interest among some, but not the passion and the emotion of the ‘60s. No one is riding in a vehicle column through the nation, stopping at gas stations to plead for an opportunity for consumers to choose among alternative or replacement fuels. No one is shouting en masse about the extensive environmental harm and economic loss caused by our reliance on gasoline. Very few are concerned with the widening income gap and increasing poverty in America. Where is the concern about the negative impact that gas prices have on the purchasing power of the poor?

Surprisingly, very few Americans seem worried that most of the wars we are fighting either overtly or covertly involve (to some degree) our or our allies’ dependence on oil and, sometimes, lead to our becoming allied with some unsavory folks. I keep remembering a relatively recent conversation I had with a special services soldier who quite clearly indicated that he and his colleagues believed the U.S. was in Iraq not because of the quest for democracy or freedom, but because of the West’s need for oil. He indicated that it was b.s. — all this talk about building democracy. Whether it’s Iraq, Syria, or Egypt, Americans themselves are having growing doubts about why we have been, are now, or might be in the future, involved in Middle Eastern wars. Many, if not most, hope that their kids are not the first in and the last out.

What is it going to take to stimulate the adrenaline of Americans when it comes to the oil industry’s ability to limit competition at the gas pump through price management, franchise agreements, and political muscle in Congress? I suspect the draft helped energize the public’s antipathy toward the Vietnam War, but for the most part, the anti-Vietnam movement secured the intense support of only a minority of Americans. Indeed, polls at the time indicated that both the women’s and the civil rights movements also had less than majority support. Yet, in all three instances, the overlapping minorities among the population wielded a big political voice, bigger than their numbers.

Why? I suspect media-savvy, bright, and committed leadership had much to do with it. Further, they were helped by the tragic assassinations of President Kennedy; his brother, U.S. Attorney General Robert Kennedy; and Martin Luther King, Jr. Growing public distrust of politicians caused by the gap between the facts on the ground and press releases concerning Vietnam increased the willingness of the American public to support the marchers. Polls began to shift on the war, civil rights, and equality for women. All three issues won increasing numbers and granted legitimacy to efforts to end the war and to assist the “have nots” and the “have less” among us. Given the federal budget authorizations and appropriations, an argument could be made that the halcyon days of the Great Society actually occurred during the first years of President Nixon. This is not heresy. Look at the budget details from 1965 through the early ‘70s.

Can we replicate the passion associated with the Vietnam War, civil rights and women’s rights movements and focus it on more democracy and freedom for consumers concerning choice of fuels? Probably not! The issues involved are difficult to grasp for the public. It is unlikely that families will sit down at the dinner table and stimulate conversation on the benefits and costs of replacement fuels or flex-fuel vehicles. Americans are not going to “March on Exxon” as they did on the Pentagon or gather at the National Mall in D.C. in the hundreds of thousands as they did for civil rights.

The term “silent majority” has been used without a hard and sustained predictable meaning in the last four or five decades. It’s a phrase that needs amplification and definition today. It could become the missing public change agent concerning replacement fuels. Coalition building among supportive pro-environmentalists, businesses, consumers, and anti-poverty groups could lead to the development of multitasked, innovative, and interactive national education program with a broad reach (e.g., town meetings, the newspaper and website articles, webinars, Twitter, movies, YouTube, etc.). Its success could convert a now-silent majority or near majority into a thoughtful, articulate majority focused on breaking up the monopoly at the pump. Success would be reflected in poll numbers supportive of federal, state, and local leaders who are willing to push for open fuel markets and increased FFVs. There would be a coalition of the willing; that is, an increasing number of Americans who would provide backbone to public policymakers who, in turn, would commit to challenging the oil companies’ understandable desire to sustain restricted fuel markets and the status quo favoring gasoline over environmentally better, safer, and cheaper replacement fuels. Their support would be conveyed through voting, and the use of innovative communication technology, rather than marching. The results would be illustrated by new, important, expanded democratically made choices by you and me, regarding fuel and vehicles — and maybe a new Woodstock composed of music celebrating America’s new freedoms. I didn’t go to the last one, but will go to the next one celebrating expanded choice for consumers, a healthier economy, and an improved environment.

“The optimist proclaims that we live in the best of all possible worlds and the pessimist fears this is true” — James Branch Cabell. Or, as I once said in a presentation in China after Tiananmen Square, “a strategic optimist is a realist with brains.”

I live with the hope we can do better as nation with respect to the environment, our economy and the quality of life choices open to Americans, particularly low- and moderate-income Americans. But I worry that given the ideological and related political divisiveness among us, we may not.

In this context, after reading the recent article, “SAFE: Report’s ‘flash points’ emphasize US transportation fuel problem” in the Oil & Gas Journal, often seen by some as a mouthpiece for the oil industry, my thoughts reflected both optimism and pessimism. I concluded that I was a realist tempered by experience (and hopefully with a brain). Okay, what did the piece suggest that stimulated my mental and emotional adrenaline? Two or three quotes used by the author Nick Snow, respected Washington editor of OGJ, taken from a national conference convened by Securing America’s Future Energy (SAFE):

“A proliferation of global oil geopolitical ‘flash points’ (e.g., conflicts in countries or within countries that limit or could limit the supply of oil) makes it even more urgent for the U.S. to aggressively reduce its dependence on crude oil for transportation fuels…If we could be only 65% dependent on oil for our transportation fuels by 2025 instead of 90%, it would make a tremendous difference…We also need better politics developed by people who can find win-win situations so we can move forward…We all agree that we need to diversify our transportation sources away from oil.”

Nick Snow is no blazing liberal. According to his resume, Mr. Snow has spent 30 years or so as a journalist covering oil issues, many of those for media outlets friendly to oil interests (e.g., Oil Daily).

Have we reached nirvana? Did the article in the OGJ signal that big or small oil companies will soon announce their commitment to replacement fuels, like natural gas-based ethanol and methanol? Their support, given the fact that some oil companies already own significant natural gas fields, could be important from a public policy and an “on the ground production and distribution” perspective.

When I was a kid, older members of my family, if they wanted something but knew it was impossible to secure, would say, “I should live so long.” In some respects, while I’m surprised by the selected quotes used in the article by Mr. Snow, I doubt it heralds an epiphany by leaders of the oil industry or their companies.

Why am I a wannabe optimist but a realistic pessimist? Oil companies’ primary behavior over the past decade or more has been to oppose the development of most replacement fuels, FFVs and open fuel markets. Sometimes they have done this through other organizations that they influence or control, and sometimes directly. Clearly, gas station franchises granted by oil companies remain tied to a “just say no” position on replacement fuels, or a back- or side-of-the-station mandate concerning location of replacement-fuel pumps. For the most part, their reaction to “flash points” has been “drill, baby, drill,” and their battle cry has been that only more drilling will make the nation oil independent. This is a curious stance, since companies are simultaneously seeking to increase their ability to export globally. America still imports about a third of its oil, while retail prices for gasoline at most stations remain high.

I’m afraid that the OGJ piece by Snow is not a harbinger of good tidings concerning oil company endorsement of replacement fuels — at least any time soon. Rather, the article reflects a willingness of the author to honestly describe a major issue facing the nation, that is, the disproportionate share of oil in transportation fuels. Regrettably, excluded from the piece is a narrative about the fact that oil converted to gasoline has a significant negative effect on the environment, and that oil imports still take a toll on the economy. Replacement fuels would address security, environmental and economic issues, and related national objectives in a much more positive way.

I have a vested interest in remembering the famous Andrews Sisters. How many of you remember them? They played in my uncle’s band for a short time. So let me end, somewhat inappropriately, using the last stanza of one of their hit tunes “I Can Dream, Can’t I?” by composer Sammy Fain. I am sure neither the sisters nor Sammy would mind. With respect to the oil companies, “I am aware. My heart is a sad affair. There is much disillusion there. But I can dream, can’t I?”

Dreaming is about all you can do now, with respect to getting oil companies to develop, or support the development of, flexible replacement fuels. Maybe someday!

Over the last year or so, many in the media have commented on the Saudization of America. Readers and viewers have been told that drilling for tight oil will lead to reduced imports and energy “independence.” Luck, or perhaps because of good ole American ingenuity in developing fracking technology, America, the Saudization folks indicate, will no longer be tethered to Middle East petroleum. “Amen” said a chorus of readers and viewers to the “drill baby drill crowd” during recent previous Presidential elections. What good red-blooded American could be against accessing America’s apparent ample supply of oil from dense rock formations or shale? Another popular win for “manifest destiny,” particularly when promises are made by the oil industry and believed by consumers that we will soon be blessed with oil independence as well as stable and ultimately lower gas prices. Who could ask for anything more?

I do not want to get into the “drill baby drill” debate– at least at this juncture. Nor, for the purposes of this piece, do I want to dwell on the opportunities and yes the problems related to fracking. What I do want to focus on is the impact of the so-called Saudization of America on consumer prices for gasoline.

Since for most of us, gas is an inelastic good and, although we express anger or dismay at its costs, we will pay the price. No doubt, you, your wife, or significant other must get gas to get to work, to shop, to take kids to school or play, to go to a doctor, and to vacation. For folks with low and moderate incomes, the costs of fuel often constrains the purchase of basic goods and services and even job choices and access to decent housing because of limited transportation budgets. Happily, Americans are getting some relief from recently sky rocketing fuel prices during this holiday season.

But think about it: Even at today’s “low” national average price of “only” about $3.25 (I paid $3.63 for regular gas this morning), the price remains relatively high. Further, the recent drop in prices probably had relatively little to do with increased production. More important in setting prices were likely lower demand, the continued slow growth of the U.S. economy, the reduction of tension in the Middle East, wall street banker and speculative behavior, monopolistic type conditions limiting consumer choices at the pump set by the oil industry as well as oil company decisions concerning market management. (It would be interesting if some independent qualified think tank or government agency undertook an in-depth factor analysis concerning variables affecting gas prices.)

Increased oil production and refinement in America likely will not have a major impact on price or price stability. Despite being produced here, oil is traded globally. Understandably and legitimately from their perspective, the behavior of producers, refiners and investors is not governed by patriotism or security interests but by return on investment (ROI). Their voices often seem bi polar. They argue for more drilling here to benefit U.S. consumers, but they often, less than transparently, translate drilling and new production into dollars stimulated by new exports or relaxation of export regulations into pleas for new drilling.

Clearly, a good share of the oil produced in the U.S. — unlike Las Vegas stories– will not stay in the U.S. It will be sold to other nations. While the oil export train (or in this case the boat) has not yet left the station, political pressure from the oil industry and its friends is beginning to generate a Washington buzz that current federal restrictions on oil exports, in place since the Arab Boycott, soon will be reduced significantly. When big oil speaks, many in Washington listen! Yet, right now production per year meets only about 50 percent of demand in the nation–

According to CNBC, “oil companies are securing licenses to export U.S. crude at the fastest rate since records began, as the shale boom leads to swelling supplies along the Gulf of Mexico. The U.S. government granted 103 licenses to ship crude oil abroad in the latest fiscal year, up by more than half from the 66 approved in fiscal 2012 and the highest since at least 2006…”

Bloomberg News notes that the surge in U.S. oil production has made the nation the world’s largest fuel exporter. Exports to Brazil grew by almost 60 percent and Venezuelan imports from the U.S. grew by more than 55 percent; So much for the cold war between the U.S. and Venezuela. As Bloomberg reports, U.S. exports of refined productions, such as gasoline and diesel, have reached new highs and increased by 130 percent since 2007.

Interestingly, Canada, despite the fact that it is the largest exporter of oil to the U. S. and has ample shale oil resources, has been the primary beneficiary of increased licenses for exports in the U.S. Less expensive U.S. gulf oil crude is a good deal for Canadians, particularly from eastern Canada. It’s cheaper than the Canadian alternative.

So despite all the noise, we still have a long way to go before we reach oil independence, a truism in part because U.S. oil will soon constitute a relatively and historically a large share of the global oil market.

Clearly, a less exuberant goal than achieving oil independence would be reducing oil dependency. Advocates of alternative fuels like natural gas and natural gas based ethanol and methanol have a strong case. Do you remember when Ronald Reagan strongly urged Mikhail Gorbachev to tear down the Berlin wall? President Obama, paraphrasing Reagan, should urge oil companies to tear down the barriers to competition at the pump and allow in alternative, safe and environmentally sound alternative fuels. Unlike other Presidents before him, the President, courageously, has already asked the nation to wean itself off of oil.

Offering consumers more choices than gasoline at “gas” stations will help reduce and stabilize fuel prices for consumers. A double win for the nation and its residents: reduced dependency and stable as well as lower costs– Happy New Year!

Just a few short months ago, newspapers, led by the WSJ, trumpeted, many on their front pages, the Saudization of America and the end of America’s and OECD’s reliance on Middle East oil. Do you remember? Well maybe you don’t have to– at least after 2025. The IEA’s World Energy Outlook for 2013, published Nov 12, indicates that the “Middle East, the only large source of low-cost oil, remains at the center of the longer-term oil outlook.” Within about 10 years or so, it will provide the largest share of the world’s expanded oil supply.

I realize the fragility of projections and have in the past criticized the IEA and the EIA and other makers of global energy projections. At times, projection makers are more artists than scientists. The good artists, sometimes, come close to what actually happens. The not so good ones either get lucky or appear to mute their “over or under” reality numbers. They either provide ranges, permitting them to say they were right in the future, or they complain, perhaps over a good bottle of wine, about the complexity of the variables.

I believe it is important to read the IEA report because it lends a bit of skepticism to the idea that America and its friends are entering the golden era of energy abundance. Indeed, The New York Times on Nov 13 ran the IEA story under the headline, “Shale’s Effect on Oil Supply Is Forecast to Be Brief.”

Here is what the IEA said in their Executive Summary:

“The role of OPEC countries in quenching the world’s thirst for oil is reduced temporarily over the next 10 years by rising output from the U.S., from oil sands in Canada, from deep water production in Brazil and from natural gas liquids from all around the world. However, by mid-2020, non-OPEC production starts to fall back and countries in the Middle East provide most of the increase in global supply. Overall national oil companies and their host governments control some 80 percent of the world’s proven-plus-probable oil reserves.”

America’s likely surplus combined with a slowdown in the increase of demand will not affect costs of oil and gasoline in a major way. Escalating demand for both will be reflected in Asia and will place a floor under prices. America’s oil companies function in a global market and are not governed to a great extent by the laws of supply and demand in this country. They will sell to the highest bidder worldwide.

IEA indicates that “the need to compensate for declining output from existing oil fields is the major driver for upstream oil investment to 2035…conventional crude output from existing fields is set to fall by more than 40 mb/d by 2035.Of the 790 billion barrels of total production required to meet our projections for demand to 2035, more than half is needed just to offset declining production. According to the NY Times, IEA conclusions are generally shared by the EIA; that is, today’s rapid oil production from shale will continue for a relatively short time and then slow rapidly. IEA indicated the slowdown will occur in the mid-twenties, EIA by the late teens.

IEA’s and EIA’s analysis should not generate a bipolar response or create a need for a regimen of pills to cure projection related manic depression. It’s only a projection. Take a deep breath and count to ten. Next year it will likely change because of “complex variables ” including but not limited to changing world demand, Middle East tension, new technology and the use of alternative fuels.

Until we get better at projection, let’s applaud IEA and EIA’s professionals. At a minimum, they are honestly and artistically responding to lots of unknowns. Paraphrasing the comedian Ilka Chase (and changing a word or two) projectionist’s minds are cleaner because they change them so often…

Just kidding!

Their efforts should at least reinforce the need to think through transportation fuel strategies and act with all reasonable speed on what I would consider, at least, low hanging fruit. For example, a coordinated campaign by the public, nonprofit and private sector to encourage the federal government to approve methanol as a fuel would be a good first step. Federal acquiescence, if combined with simultaneous certification of low cost kits to convert existing vehicles to flex fuel cars could provide the framework for an effective transitional fuel strategy.

It, likely, will take from five to ten years before electric and or hydrogen powered vehicles will be able to reach the budgets and driving needs of most low, and moderate income Americans. Even when renewable fuel powered new vehicles reach a mass market, the technology will not be able to change the gasoline dependent older vehicles. In this context, alternative transitional fuels could, with the addition of an increased number of conveniently located fuel stations and stimulated by new demand, offer competition to oil company restricted gas-only stations and consumers a choice of fuels. America would be better off economically and environmentally. Consumers would secure a more predictable, probably lower price for fuel at competitive pumps and charging stations. The nation would be less dependent on imported oil.

California still is seen as the state that exports innovation, despite the fact that it has seen some tough economic times of late. In this context, I was pleased to see the recognition granted by the Orange County Register (Nov 6) to the Clean Energy Fuel Corporation, and its efforts to build the Natural Gas Highway. I was even more surprised to find out that the corporate offices were located near my own office. Clearly, the popularity of natural gas and its derivatives, ethanol and methanol, are on the uptake since the President’s State of the Union address indicating the nation’s economy and environment would benefit if it weaned itself off oil and by implication gasoline. Even before Obama’s speech, there was a growing recognition among many Americans– including environmental and business leaders– that natural gas could become the core of a strategy aimed at reducing greenhouse gas (GHG) and other pollutants, lowering the costs of vehicular fuel, and reducing dependency on oil imports, thus providing funds for investment in the U.S. Clean Energy Fuels Corporation, located in Newport Beach, is making it easier for consumers to access natural gas for their vehicles. According to the story in the Register, it has invested more than $300 million in the last two years on natural gas fuel stations across the nation. Most of the more than 400 stations that they have developed and offer only compressed natural gas (CNG), a fuel that works better for comparatively short trips ( e.g. buses, taxis, garbage trucks, short hall trucks, local consumers ). Current and future placement of stations will increasingly offer liquid natural gas (LNG). LNG works better than CNG for long distance trips. Are the leaders of the Clean Energy Fuel Corporation nuts? Maybe they are…but I don’t believe so. While, the Corporation has yet to turn a profit (apparently after 15 or 16 years), since going public in 2007, their market value is now more than 1 billion dollars. Their phones are ringing. Large retailing companies relying on trucks, long distance trucking companies, bus manufacturers, taxis and bus companies seem to be gravitating toward use of cheaper natural gas as a fuel. But these users and potential users need assurances that natural gas fuel stations will be reasonably accessible. Clean Energy Fuel aims to provide such assurances. Many respected financial analysts believe that the Clean Energy Fuel Corporation is on the cusp of and will benefit financially from the increased acceptance and growth of alternative transportation fuels, particularly natural gas. Assuming both the sizable price gap between oil and natural gas remains and the corresponding price gap between natural gas fuel and gasoline as well as between natural gas and diesel fuel stays relatively large; Clean Energy Fuel Corporation’s future looks bright. Yes, it will have rivals. Shell Oil, according to the Register article, apparently is going to start selling LNG at existing truck stops. Soundings that I have picked up from natural gas leaders, CEOS of businesses dependent on trucking and diverse investors suggest an evolving interest in developing both CNG and LNG fuel stations and the Natural Gas Highway. In this context, 22 states, under the bipartisan leadership of Governor John Hickenlooper (D) of Colorado and Governor Mary Fallin (R) of Oklahoma, have initiated a collaborative project to buy CNG outfitted cars from Detroit to replace old state vehicles, when their time passes. Detroit in turn has promised to develop a less expensive CNG vehicle for the participating states which could ultimately benefit consumers. Given recent projections of the market for natural gas fuel by government and reputable private and nonprofit groups and increased advocacy for alternative fuels by a coalition of environmental, nonprofit and business groups, I wouldn’t bet against Clean Energy Fuel’s future health. My hope, however, is that it and, indeed, its competitors add room for natural gas derivatives such as ethanol and methanol in their planned natural gas stations. Apart from generating use by owners of flex fuel cars now in existence, their agreement to do so would encourage (the relatively inexpensive and easy) conversion of existing vehicles to flex fuel vehicles. Significantly, EPA has certified the use of E10 in all vehicles, E15 in vehicles after 2001 and E85 in approved flex fuel vehicles. Hopefully, EPA will soon certify methanol as well as approve an expanded list of conversion kits for existing older vehicles. These approvals are possible, if not probable, given the environmental, economic and consumer benefits of alternative fuels and the evolving politics of fuel. Allowing oil companies to sustain the very restrictive rules now governing the vehicular fuel market will continue to prop up America’s dependency on imported oil as well as support relatively high fuel costs and increased environmental degradation. President and CEO Andrew Littlefair of Clean Energy Fuel indicated, “With cheaper, abundant fuel, a network of stations, [and] redesigned engines …the time for natural gas transportation has arrived.” I would add, the time for natural gas based ethanol and methanol has also arrived. I commend Clean Energy Fuel for its initiative in developing the Natural Gas Highway. The Company, borrowing from President John Kennedy, has begun an important journey of thousands of miles in Newport Beach. Contrary to (and paraphrasing) the poet Robert Frost, hopefully the road they are building will be very well travelled. Maybe a couple of leisurely lunches near the ocean in beautiful Newport Beach could convince my colleagues at Clean Energy Fuel to consider working with producers of natural gas based ethanol and methanol as well as interested states and localities to extend the Natural Gas Highway to ethanol and methanol. It would be good for traffic and their bottom line, good for development of related commercial activities and, most important, good for America