Trump pro-ethanol measures a win for consumers?

While allowing year-round E15 opens the door to using more alcohol fuels, it doesn’t create the market competition that’s needed to achieve energy independence.

While allowing year-round E15 opens the door to using more alcohol fuels, it doesn’t create the market competition that’s needed to achieve energy independence.

For nearly a decade now, most gasoline sold in the U.S. has contained 10 percent ethanol. This allowed us to do away with toxic additives like BTEX and reduce our dependence on foreign oil.

California has a history being the first across the line when it comes to protecting the environment.

Racin’ is a lot of things (maybe even rubbin’ … Robert Duvall and Tom Cruise didn’t exactly settle the matter in “Days of Thunder”). NASCAR fans usually don’t think “reducin’ emissions” as part of the equation of their favorite sport. But they should.

As the Iowa caucuses shape up for February, one thing is becoming clear: Support for ethanol is no longer a sine qua non for aspiring presidential candidates.

One of the most often-repeated attacks on ethanol we hear is that “It hurts my engine.” We hear it from people who buy into the oil companies’ misinformation; from people who are (reasonably) concerned about using a new fuel type after 100 years of using the same gasoline tank after tank; and even from car people who insist that it’s the small portion of ethanol — not the dirtier gasoline — that is responsible for engine deposits and wear on fuel systems.

Here’s the truth: Some older vehicles should not use any ethanol blend above E10, which is up to 10 percent ethanol and what virtually all of us use as regular gasoline. Higher ethanol blends also aren’t approved for motorcycles, boats and yard equipment. But E15 is approved for all vehicles model year 2001 and newer, and there are more than 17 million cars, trucks and SUVs on the road in the U.S. that are flex-fuel vehicles — built to run on E85, which is between 51 percent and 83 percent ethanol.

What happens if a non-FFV uses E85? As many of our supporters on social media have noted, nothing. No engine damage, no corrosion of parts, no locusts descending, nothing bad at all. All that happens is that they pay less at the pump, and go to sleep at night knowing that they’ve made the world a tiny bit better place, because they’ve used an American-made fuel that emits fewer toxic pollutants than gasoline.

In a post last week on Green Car Reports, writer John Voelcker mentioned research promoted by the Urban Air Initiative showing that ethanol-free gasoline (E0) is more corrosive than E10. But Voelcker then takes a swipe at higher ethanol blends:

Ethanol in its purer forms, specifically E85, is long accepted as more corrosive to rubber and other engine components than gasoline.

That’s why carmakers have to develop “Flex-Fuel” engines specifically designed to withstand the effects of fuel that contains a majority of ethanol.

I e-mailed Voelcker’s post to Marc Rauch, executive vice president and co-editor of The Auto Channel (and one of the breakout stars of our 2014 documentary PUMP), and he called me right away. Weary over the persistent “corrosive” debate point, Rauch asked whether ethanol — which is also called ethyl alcohol, grain alcohol or “moonshine” — ate away at the plastic bottles that hold such booze at the liquor store. The answer is no.

“What people don’t get is, everything is corrosive,” he said. “You have to find a material that is not as susceptible to corrosion.”

Rauch then went to the comments section of the Green Car Reports post to elaborate:

Ethanol opponents trump up mythical ethanol mandate predictions and horrific false stories of ethanol-caused damage to frighten consumers. The boating community is a prime example. If boat owners want to hear some truthful comments about ethanol blends they should watch the Vernon Barfield ethanol boating videos on YouTube and listen to the Mercury Marine “Myths of Ethanol and Fuel Care” webinar from August 2011.

… In fact, water is corrosive; wind is corrosive; air is corrosive; gasoline is corrosive; solar rays are corrosive; moving parts are corrosive; human interaction with seating and flooring materials is corrosive.

The reality is that auto manufacturers have had to develop “specially designed” containers to hold water for automatic window washing. That’s right, if they used most metals to hold the water it would rust and/or corrode. Manufacturers had to develop “specially designed” coatings or parts to prevent chassis and fenders and bumpers from water corrosion. Manufacturers had to develop “specially designed” body paint and rubber to prevent solar corrosion. And, over the years auto manufacturers had to develop “specially designed” engine parts, rubber, and body paint that was resistant to the corrosive characteristics of gasoline and diesel.

In other words, if auto manufacturers had to make some alterations to accommodate ethanol, so what? It’s not even worth a serious discussion, and it certainly doesn’t befit a person like you who is supposed to know something about automobiles and industrial engineering.

There’s more good stuff there. Take a look.

If you’d like to see Rauch bat away that and other myths about ethanol one by one, or ask him a question yourself, he’s going to be taking part in a special Twitter conversation with @fuelfreedomnow on Wednesday at 12 noon. Follow the hashtag #FuelChat.

Related content:

The Greeks are going broke…slowly! The Russians are bipolar with respect to Ukraine! Rudy Giuliani has asked the columnist Ann Landers (she was once a distant relative of the author) about the meaning of love! President Obama, understandably, finds more pleasure in the holes on a golf course than the deep political holes he must jump over in governing, given the absence of bipartisanship.

But there is good news! Many ethanol producers and advocacy groups, with enough love for America to encompass this past Valentine’s Day and the next (and of course, with concern for profits), have acknowledged that a vibrant, vigorous, loving market for E85 is possible, if E85 costs are at least 20 percent below E10 (regular gasoline) — a percentage necessary to accommodate the fact that E10 gas gets more mileage per gallon than E85. Consumers may soon have a choice at more than a few pumps.

But there is good news! Many ethanol producers and advocacy groups, with enough love for America to encompass this past Valentine’s Day and the next (and of course, with concern for profits), have acknowledged that a vibrant, vigorous, loving market for E85 is possible, if E85 costs are at least 20 percent below E10 (regular gasoline) — a percentage necessary to accommodate the fact that E10 gas gets more mileage per gallon than E85. Consumers may soon have a choice at more than a few pumps.

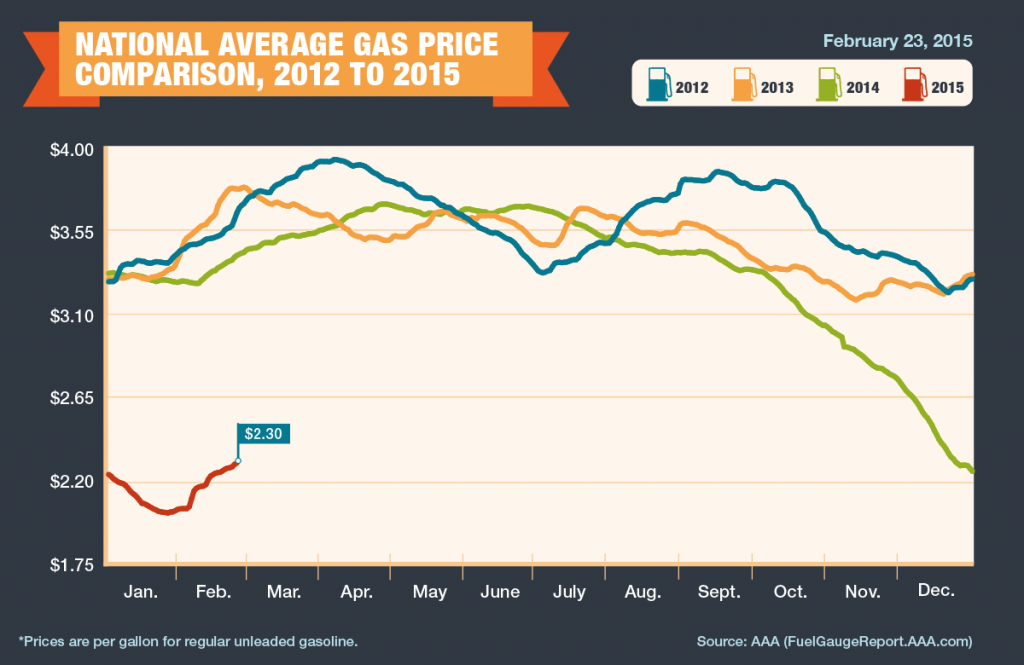

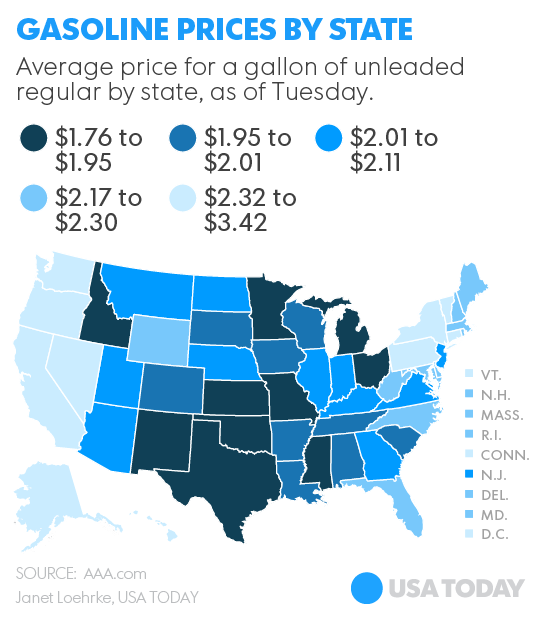

In recent years, the E85 supply chain has been able to come close, in many states, to a competitive cost differential with respect to E10. Indeed, in some states, particularly states with an abundance of corn (for now, ethanol’s principal feedstock), have come close to or exceeded market-based required price differentials. Current low gas prices resulting from the decline of oil costs per barrel have thrown price comparisons between E85 and E10 through a bit of a loop. But the likelihood is that oil and gasoline prices will rise over the next year or two because of cutbacks in the rate of growth of production, tension in the Middle East, growth of consumer demand and changes in currency value. Assuming supply and demand factors follow historical patterns and government policies concerning, the use of RNS credits and blending requirements regarding ethanol are not changed significantly, E85 should become more competitive on paper at least pricewise with gasoline.

Ah! But life is not always easy for diverse ethanol fuel providers — particularly those who yearn to increase production so E85 can go head-to-head with E10 gasoline. Maybe we can help them.

Psychiatrists, sociologists and poll purveyors have not yet subjected us to their profound articles concerning the possible effect of low gas prices on consumers, particularly low-income consumers. Maybe, just maybe, a first-time, large grass-roots consumer-based group composed of citizens who love America will arise from the good vibes and better household budgets caused by lower gas prices. Maybe, just maybe, they will ask continuous questions of their congresspersons, who also love America, querying why fuel prices have to return to the old gasoline-based normal. Similarly, aided by their friendly and smart economists, maybe, just maybe, they will be able to provide data and analysis to show that if alternative lower-cost based fuels compete on an even playing field with gasoline and substitute for gasoline in increasing amounts, fuel prices at the pump will likely reflect a new lower-cost based normal favorable to consumers. It’s time to recognize that weakening the oil industry’s monopolistic conditions now governing the fuel market would go a long way toward facilitating competition and lowering prices for both gasoline and alternative fuels. It, along with some certainty concerning the future of the renewable fuels program, would also stimulate investor interest in sorely needed new fuel stations that would facilitate easier consumer access to ethanol.

Who is for an effective Open Fuel Standard Program? People who love America! It’s the American way! Competition, not greed, is good! Given the oil industry’s ability to significantly influence, if not dominate, the fuel market, it isn’t fair (and maybe even legal) for oil companies to legally require franchisees to sell only their brand of gasoline at the pump or to put onerous requirements on the franchisees should they want to add an E85 pump or even an electric charger. It is also not right (or likely legal) for an oil company and or franchisee to put an arbitrarily high price on E85 in order to drive (excuse the pun) consumers to lower priced gasoline?

Although price is the key barrier, now affecting the competition between E85 and E10, it is not the only one. In this context, ethanol’s supply chain participants, including corn growers, and (hopefully soon) natural gas providers, need to review alternate, efficient and cost-effective ways to produce, blend, distribute and sell their product. More integration, cognizant of competitive price points and consistent with present laws and regulations, including environmental laws and regulations, is important.

The ethanol industry and its supporters have done only a fair to middling job of responding to the oil folks and their supporters who claim that E15 will hurt automobile engines and E85 may negatively affect newer FFVs and older internal combustion engines converted to FFVs. Further, their marketing programs and the marketing programs of flex-fuel advocates have not focused clearly on the benefits of ethanol beyond price. Ethanol is not a perfect fuel but, on most public policy scales, it is better than gasoline. It reflects environmental, economic and security benefits, such as reduced pollutants and GHG emissions, reduced dependency on foreign oil and increased job potential. They are worth touting in a well-thought-out, comprehensive marketing initiative, without the need to use hyperbole.

America and Americans have done well when monopolistic conditions in industrial sectors have lessened or have been ended by law or practice (e.g., food, airlines, communication, etc.). If you love America, don’t leave the transportation and fuel sector to the whims and opportunity costing of the oil industry.

Some environmentalists believe that if you invest in and develop alternative replacement fuels (e.g., ethanol, methanol, natural gas, etc.) innovation and investment with respect to the development of fuel from renewables will diminish significantly. They believe it will take much longer to secure a sustainable environment for America.

Some environmentalists believe that if you invest in and develop alternative replacement fuels (e.g., ethanol, methanol, natural gas, etc.) innovation and investment with respect to the development of fuel from renewables will diminish significantly. They believe it will take much longer to secure a sustainable environment for America.

Some of my best friends are environmentalists. Most times, I share their views. I clearly share their views about the negative impact of gasoline on the environment and GHG emissions.

I am proud of my environmental credentials and my best friends. But fair is fair — there is historical and current evidence that environmental critics are often using hyperbole and exaggeration inimical to the public interest. At this juncture in the nation’s history, the development of a comprehensive strategy linking increased use of alternative replacement fuels to the development and increased use of renewables is feasible and of critical importance to the quality of the environment, the incomes of the consumer, the economy of the nation, and reduced dependence on imported oil.

There you go again say the critics. Where’s the beef? And is it kosher?

Gasoline prices are at their lowest in years. Today’s prices convert gasoline — based on prices six months ago, a year ago, two years ago — into, in effect, what many call a new product. But is it akin to the results of a disruptive technology? Gas at $3 to near $5 a gallon is different, particularly for those who live at the margin in society. Yet, while there are anecdotes suggesting that low gas prices have muted incentives and desire for alternative fuels, the phenomena will likely be temporary. Evidence indicates that new ethanol producers (e.g., corn growers who have begun to blend their products or ethanol producers who sell directly to retailers) have entered the market, hoping to keep ethanol costs visibly below gasoline. Other blenders appear to be using a new concoction of gasoline — assumedly free of chemical supplements and cheaper than conventional gasoline — to lower the cost of ethanol blends like E85.

Perhaps as important, apparently many ethanol producers, blenders and suppliers view the decline in gas prices as temporary. Getting used to low prices at the gas pump, some surmise, will drive the popularity of alternative replacement fuels as soon as gasoline, as is likely, begins the return to higher prices. Smart investors (who have some staying power), using a version of Pascal’s religious bet, will consider sticking with replacement fuels and will push to open up local, gas-only markets. The odds seem reasonable.

Now amidst the falling price of gasoline, General Motors did something many experts would not have predicted recently. Despite gas being at under $2 in many areas of the nation and still continuing to decrease, GM, with a flourish, announced plans, according to EPIC (Energy Policy Information Agency), to “release its first mass-market battery electric vehicle. The Chevy Bolt…will have a reported 200 mile range and a purchase price that is over $10,000 below the current asking price of the Volt.It will be about $30,000 after federal EV tax incentives. Historically, although they were often startups, the recent behavior of General Motor concerning electric vehicles was reflected in the early pharmaceutical industry, in the medical device industry, and yes, even in the automobile industry etc.

GM’s Bolt is the company’s biggest bet on electric innovation to date. To get to the Bolt, GM researched Tesla and made a $240 million investment in one of its transmissions plan.

Maybe not as media visible as GM’s announcement, Blume Distillation LLC just doubled its Series B capitalization with a million-dollar capital infusion from a clean tech seed and venture capital fund. Tom Harvey, its vice president, indicated Blume’s Distillation system can be flexibly designed and sized to feedstock availability, anywhere from 250,000 gallons per year to 5 MMgy. According to Harvey, the system is focused on carbohydrate and sugar waste streams from bottling plants, food processors and organic streams from landfill operations, as well as purpose-grown crops.

The relatively rapid fall in gas prices does not mean the end of efforts to increase use of alternative replacement fuels or renewables. Price declines are not to be confused with disruptive technology. Despite perceptions, no real changes in product occurred. Gas is still basically gas. The change in prices relates to the increased production capacity generated by fracking, falling global and U.S. demand, the increasing value of the dollar, the desire of the Saudis to secure increased market share and the assumed unwillingness of U.S. producers to give up market share.

Investment and innovation will continue with respect to alcohol-based alternative replacement and renewable fuels. Increasing research in and development of both should be part of an energetic public and private sector’s response to the need for a new coordinated fuel strategy. Making them compete in a win-lose situation is unnecessary. Indeed, the recent expanded realization by environmentalists critical of alternative replacement fuels that the choices are not “either/or” but are “when/how much/by whom,” suggesting the creation of a broad coalition of environmental, business and public sector leaders concerned with improving the environment, America’s security and the economy. The new coalition would be buttressed by the fact that Americans, now getting used to low gas prices, will, when prices rise (as they will), look at cheaper alternative replacement fuels more favorably than in the past, and may provide increasing political support for an even playing field in the marketplace and within Congress. It would also be buttressed by the fact that increasing numbers of Americans understand that waiting for renewable fuels able to meet broad market appeal and an array of household incomes could be a long wait and could negatively affect national objectives concerning the health and well-being of all Americans. Even if renewable fuels significantly expand their market penetration, their impact will be marginal, in light of the numbers of older internal combustion cars now in existence. Let’s move beyond a win-lose “muddling through” set of inconsistent policies and behavior concerning alternative replacement fuels and renewables and develop an overall coordinated approach linking the two. Isaiah was not an environmentalist, a businessman nor an academic. But his admonition to us all to come and reason together stands tall today.

One of the most compelling moments in the documentary PUMP comes when we’re introduced to Phil and Cheryl Near, who own two gas stations called Jump Start in Wichita, Kansas.

They’re not ordinary stations, however: They could be the fueling stations of the future, because they sell ethanol as well as traditional gasoline.

Phil Near, 51, has worked in the gasoline business virtually his entire adult life, and only a few years back discovered that there were alternatives, like ethanol. Now he and Cheryl offer it to customers, spreading the word about the benefits of fuel choice. “Once they try it, they usually come back and buy it again,” Phil says in the film.

More importantly, he says selling ethanol “is a moral obligation. We feel like we’re doing the Lord’s work.”

To learn more about the film, visit PumpTheMovie.com, and just in time for Christmas, you can give the gift of thought-provoking debate by pre-ordering your digital copy on iTunes prior to its Jan. 13 launch.

Until then, here’s a Q&A we did with Phil and Cheryl recently about their work and their passion:

Fuel Freedom: People who believe in alternatives to oil were caught off guard by the drop in oil prices. How do you handle it when people say: “Gas is so cheap, so why do we need to consider alternatives?”

Phil: People who have made the decision to use E85 are going to do that, as long as it doesn’t cost them more money. Some will use it no matter what. I think that having a lower price, where the economics are better for the consumer, will continue to drive new customers as they acquire cars that are flex vs. cars that are not. (The price) is inverted right now: It actually costs us more money than gasoline does now. So we’re losing margin today because we feel like we have to be competitive between the two products to maintain our customer base. That’s not necessarily a good place to be, but it’ just kind of a reality of the fuel business. … Sometimes you just have to bite the bullet, and you don’t like it, but you’ve got to just fight the fight.

FF: How much do you pay for the ethanol you sell?

Phil: At one store we sell E85, and then we have the three grades of gasoline (87, 89 and 91). At the second store we have 87 and 91, then we have E15, E30 and E85. Our cost today on unleaded is a little over $2, retails $2.28, which is an abnormally large margin because the price is falling faster at the rack than the street, but it’s catching up. E85, we’re matching the unleaded price, $2.28. But it’s costing us about 15 cents a gallon more than that.

FF: What needs to happen to move the needle to create more flex-fuel vehicles, or create more stations?

Cheryl: One of the big things is education. My daughter had a car worked on at a dealership in town. I was talking to some of the service guys … and I talked about what we do, (that) we sell E85. And this guy goes, “Oh, I tell all my customers, ‘Don’t put E85 in your car. It’s bad for your car; it burns hotter.’ “ And I go, ‘Well, actually, it burns cooler, and higher octane is good for your car.’ “ But the oil companies have spent so much money with all this negative propaganda, and a lot of people have fallen into it. Car dealerships are the worst. They are telling their people not to use E85 in their flex-fuel vehicles, from the experiences that I’ve had.

FF: It’s amazing that a dealership would tell someone not to put E85 in a flex-fuel vehicle when it’s built to run on it.

Cheryl: And in the state of Kansas, there’s a $750 tax credit, if you use 500 gallons in a calendar year. And the dealerships aren’t telling people, they’re not promoting that. So people could be using E85 and getting that tax credit, and they’re just leaving it on the table, because the dealerships – whether they don’t know about it, or they just don’t want to tell people about it – it’s not being promoted.

FF: In the film you talk about selling ethanol being “the Lord’s work.” What does that mean to you?

Phil: At one time I had one of the largest fuel-distribution companies in the Midwest (Crescent Oil Co.). And it really wasn’t until I was out of that company that I understood how much control not only do the oil companies have on what happens here in the U.S., but how much control there is worldwide on energy. And I have a real passion for the fact that I feel like our great country is being stripped of its wealth for energy, and our jobs are going away. We’re right on the edge of Oklahoma, so during the oil heyday, we saw what that did economically for the communities and the people. And when the oil business went away, it really damaged a lot of towns in Oklahoma, and southern Kansas, and Texas. Back in 2006, I started learning a little bit about E85 and kind of the push, with a few ethanol plants being built in the Midwest. I saw what it does as far as creating opportunities. In small towns, these rural towns where these plants are being built, it’s a major impact on the communities.

But what most people don’t even think about every time they fill their car up with gas is, we’re sending the money we pay for energy out of our country. I call it “stripping the wealth.” Obviously, renewables is what I really feel like we’re supposed to be doing. Obviously it’s better for the economy, it’s better for the environment. We’re stewards of this Earth, and we need to be taking care of it. Oil is dirty energy; coal is dirty energy. These things that pollute the environment, as well as really hurt the financial position of our great country.

Cheryl: As a female and a mother, my biggest fear is that we’ll be a generation (or maybe the next generation) that completely depletes all of the fossil-fuel reserves, and then we’re leaving great-grandchildren, great-great-grandchildren, in a mess. This generation, if we don’t start working on this, we’re leaving a really big mess for future generations. I really worry about that. In the Bible, it says we’re supposed to be stewards of the Earth. God left it for us to take care of. I say it in the documentary: “I think we’re messing up.” I don’t think we’re doing a very good job.

Phil: I was taught something that really hit home, and that was: You can’t create energy; you can only transfer energy. Only the Lord created energy. And whether you transfer it from oil, or from wind or solar, or ethanol, from corn or whatever you may, we’re all missing the boat. It’s all transfer, it’s not created.

Cheryl: That actually came from my father (Ray Jones), who’s an engineer. But he was teaching us that: He said, ‘You can’t make energy, you transfer energy. And you lose a little energy every time you transfer it.’ We’d never really heard that before. We were kind of fascinated by that.

Phil: He was one of the design engineers on the NASA moon buggy; he was a pretty smart cat. But he taught us that. And every source (of energy) was one the Lord gave us.

I spent my whole career in the industry, and most people don’t stop and think, and I didn’t for a long time, that our economic model for the world is all controlled by energy. Everything. You can’t get food without energy, you can’t move goods and services. Everything is driven off energy, and we’ve been sending soldiers to war for a long time to protect energy that we don’t even own.

A Renewable Fuels Association analysis of model year (MY) 2015 warranty statements and owner’s manuals reveals that auto manufacturers explicitly approve the use of E15 (15 percent ethanol, 85 percent gasoline) in approximately two-thirds of new vehicles. E15 is approved by U.S. EPA for all 2001 and newer vehicles — accounting for roughly 80 percent of the vehicles on the road today.

Read more at: Ethanol Producer Magazine