One of the most compelling moments in the documentary PUMP comes when we’re introduced to Phil and Cheryl Near, who own two gas stations called Jump Start in Wichita, Kansas.

They’re not ordinary stations, however: They could be the fueling stations of the future, because they sell ethanol as well as traditional gasoline.

Phil Near, 51, has worked in the gasoline business virtually his entire adult life, and only a few years back discovered that there were alternatives, like ethanol. Now he and Cheryl offer it to customers, spreading the word about the benefits of fuel choice. “Once they try it, they usually come back and buy it again,” Phil says in the film.

More importantly, he says selling ethanol “is a moral obligation. We feel like we’re doing the Lord’s work.”

To learn more about the film, visit PumpTheMovie.com, and just in time for Christmas, you can give the gift of thought-provoking debate by pre-ordering your digital copy on iTunes prior to its Jan. 13 launch.

Until then, here’s a Q&A we did with Phil and Cheryl recently about their work and their passion:

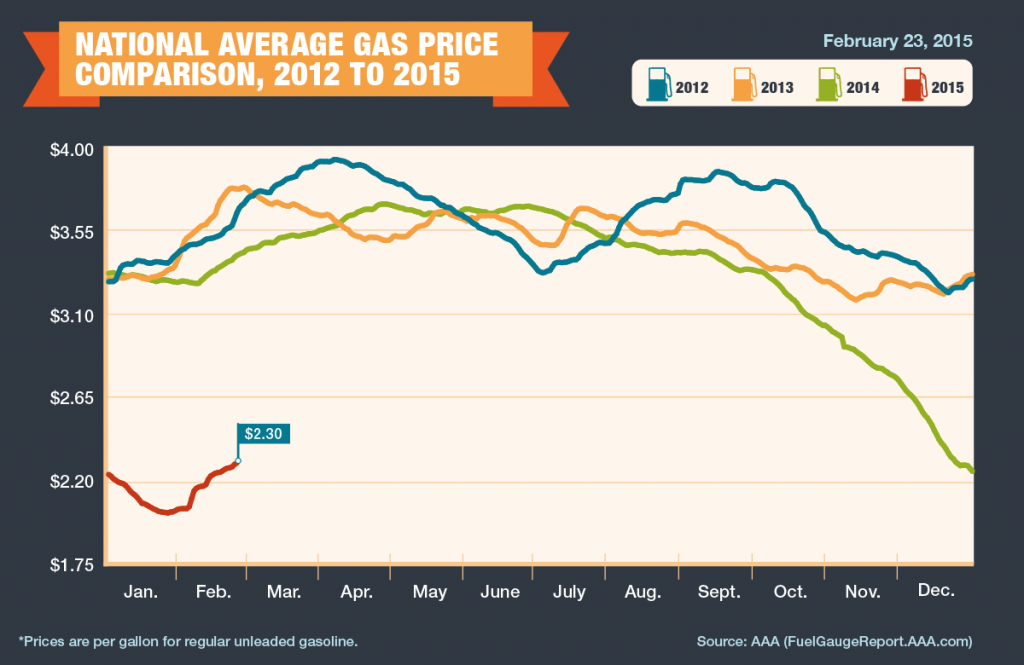

Fuel Freedom: People who believe in alternatives to oil were caught off guard by the drop in oil prices. How do you handle it when people say: “Gas is so cheap, so why do we need to consider alternatives?”

Phil: People who have made the decision to use E85 are going to do that, as long as it doesn’t cost them more money. Some will use it no matter what. I think that having a lower price, where the economics are better for the consumer, will continue to drive new customers as they acquire cars that are flex vs. cars that are not. (The price) is inverted right now: It actually costs us more money than gasoline does now. So we’re losing margin today because we feel like we have to be competitive between the two products to maintain our customer base. That’s not necessarily a good place to be, but it’ just kind of a reality of the fuel business. … Sometimes you just have to bite the bullet, and you don’t like it, but you’ve got to just fight the fight.

FF: How much do you pay for the ethanol you sell?

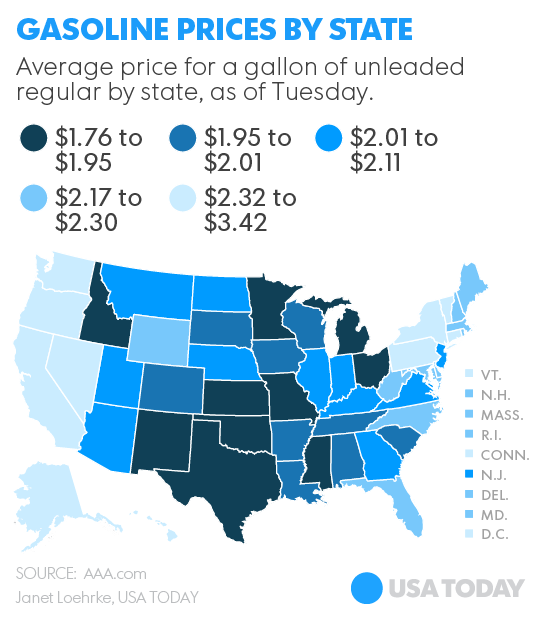

Phil: At one store we sell E85, and then we have the three grades of gasoline (87, 89 and 91). At the second store we have 87 and 91, then we have E15, E30 and E85. Our cost today on unleaded is a little over $2, retails $2.28, which is an abnormally large margin because the price is falling faster at the rack than the street, but it’s catching up. E85, we’re matching the unleaded price, $2.28. But it’s costing us about 15 cents a gallon more than that.

FF: What needs to happen to move the needle to create more flex-fuel vehicles, or create more stations?

Cheryl: One of the big things is education. My daughter had a car worked on at a dealership in town. I was talking to some of the service guys … and I talked about what we do, (that) we sell E85. And this guy goes, “Oh, I tell all my customers, ‘Don’t put E85 in your car. It’s bad for your car; it burns hotter.’ “ And I go, ‘Well, actually, it burns cooler, and higher octane is good for your car.’ “ But the oil companies have spent so much money with all this negative propaganda, and a lot of people have fallen into it. Car dealerships are the worst. They are telling their people not to use E85 in their flex-fuel vehicles, from the experiences that I’ve had.

FF: It’s amazing that a dealership would tell someone not to put E85 in a flex-fuel vehicle when it’s built to run on it.

Cheryl: And in the state of Kansas, there’s a $750 tax credit, if you use 500 gallons in a calendar year. And the dealerships aren’t telling people, they’re not promoting that. So people could be using E85 and getting that tax credit, and they’re just leaving it on the table, because the dealerships – whether they don’t know about it, or they just don’t want to tell people about it – it’s not being promoted.

FF: In the film you talk about selling ethanol being “the Lord’s work.” What does that mean to you?

Phil: At one time I had one of the largest fuel-distribution companies in the Midwest (Crescent Oil Co.). And it really wasn’t until I was out of that company that I understood how much control not only do the oil companies have on what happens here in the U.S., but how much control there is worldwide on energy. And I have a real passion for the fact that I feel like our great country is being stripped of its wealth for energy, and our jobs are going away. We’re right on the edge of Oklahoma, so during the oil heyday, we saw what that did economically for the communities and the people. And when the oil business went away, it really damaged a lot of towns in Oklahoma, and southern Kansas, and Texas. Back in 2006, I started learning a little bit about E85 and kind of the push, with a few ethanol plants being built in the Midwest. I saw what it does as far as creating opportunities. In small towns, these rural towns where these plants are being built, it’s a major impact on the communities.

But what most people don’t even think about every time they fill their car up with gas is, we’re sending the money we pay for energy out of our country. I call it “stripping the wealth.” Obviously, renewables is what I really feel like we’re supposed to be doing. Obviously it’s better for the economy, it’s better for the environment. We’re stewards of this Earth, and we need to be taking care of it. Oil is dirty energy; coal is dirty energy. These things that pollute the environment, as well as really hurt the financial position of our great country.

Cheryl: As a female and a mother, my biggest fear is that we’ll be a generation (or maybe the next generation) that completely depletes all of the fossil-fuel reserves, and then we’re leaving great-grandchildren, great-great-grandchildren, in a mess. This generation, if we don’t start working on this, we’re leaving a really big mess for future generations. I really worry about that. In the Bible, it says we’re supposed to be stewards of the Earth. God left it for us to take care of. I say it in the documentary: “I think we’re messing up.” I don’t think we’re doing a very good job.

Phil: I was taught something that really hit home, and that was: You can’t create energy; you can only transfer energy. Only the Lord created energy. And whether you transfer it from oil, or from wind or solar, or ethanol, from corn or whatever you may, we’re all missing the boat. It’s all transfer, it’s not created.

Cheryl: That actually came from my father (Ray Jones), who’s an engineer. But he was teaching us that: He said, ‘You can’t make energy, you transfer energy. And you lose a little energy every time you transfer it.’ We’d never really heard that before. We were kind of fascinated by that.

Phil: He was one of the design engineers on the NASA moon buggy; he was a pretty smart cat. But he taught us that. And every source (of energy) was one the Lord gave us.

I spent my whole career in the industry, and most people don’t stop and think, and I didn’t for a long time, that our economic model for the world is all controlled by energy. Everything. You can’t get food without energy, you can’t move goods and services. Everything is driven off energy, and we’ve been sending soldiers to war for a long time to protect energy that we don’t even own.

But there is good news! Many ethanol producers and advocacy groups, with enough love for America to encompass this past Valentine’s Day and the next (and of course, with concern for profits), have acknowledged that a vibrant, vigorous, loving market for E85 is possible, if E85 costs are at least 20 percent below E10 (regular gasoline) — a percentage necessary to accommodate the fact that E10 gas gets more mileage per gallon than E85. Consumers may soon have a choice at more than a few pumps.

But there is good news! Many ethanol producers and advocacy groups, with enough love for America to encompass this past Valentine’s Day and the next (and of course, with concern for profits), have acknowledged that a vibrant, vigorous, loving market for E85 is possible, if E85 costs are at least 20 percent below E10 (regular gasoline) — a percentage necessary to accommodate the fact that E10 gas gets more mileage per gallon than E85. Consumers may soon have a choice at more than a few pumps.