The dangers of being dependent on foreign oil

So we’re dependent on foreign oil. How bad could that be?

So we’re dependent on foreign oil. How bad could that be?

14 dollars and 81 cents.

That’s how much I’ve spent on gasoline since I leased a 2016 Chevy Volt near the end of November. Read more →

The Greeks are going broke…slowly! The Russians are bipolar with respect to Ukraine! Rudy Giuliani has asked the columnist Ann Landers (she was once a distant relative of the author) about the meaning of love! President Obama, understandably, finds more pleasure in the holes on a golf course than the deep political holes he must jump over in governing, given the absence of bipartisanship.

But there is good news! Many ethanol producers and advocacy groups, with enough love for America to encompass this past Valentine’s Day and the next (and of course, with concern for profits), have acknowledged that a vibrant, vigorous, loving market for E85 is possible, if E85 costs are at least 20 percent below E10 (regular gasoline) — a percentage necessary to accommodate the fact that E10 gas gets more mileage per gallon than E85. Consumers may soon have a choice at more than a few pumps.

But there is good news! Many ethanol producers and advocacy groups, with enough love for America to encompass this past Valentine’s Day and the next (and of course, with concern for profits), have acknowledged that a vibrant, vigorous, loving market for E85 is possible, if E85 costs are at least 20 percent below E10 (regular gasoline) — a percentage necessary to accommodate the fact that E10 gas gets more mileage per gallon than E85. Consumers may soon have a choice at more than a few pumps.

In recent years, the E85 supply chain has been able to come close, in many states, to a competitive cost differential with respect to E10. Indeed, in some states, particularly states with an abundance of corn (for now, ethanol’s principal feedstock), have come close to or exceeded market-based required price differentials. Current low gas prices resulting from the decline of oil costs per barrel have thrown price comparisons between E85 and E10 through a bit of a loop. But the likelihood is that oil and gasoline prices will rise over the next year or two because of cutbacks in the rate of growth of production, tension in the Middle East, growth of consumer demand and changes in currency value. Assuming supply and demand factors follow historical patterns and government policies concerning, the use of RNS credits and blending requirements regarding ethanol are not changed significantly, E85 should become more competitive on paper at least pricewise with gasoline.

Ah! But life is not always easy for diverse ethanol fuel providers — particularly those who yearn to increase production so E85 can go head-to-head with E10 gasoline. Maybe we can help them.

Psychiatrists, sociologists and poll purveyors have not yet subjected us to their profound articles concerning the possible effect of low gas prices on consumers, particularly low-income consumers. Maybe, just maybe, a first-time, large grass-roots consumer-based group composed of citizens who love America will arise from the good vibes and better household budgets caused by lower gas prices. Maybe, just maybe, they will ask continuous questions of their congresspersons, who also love America, querying why fuel prices have to return to the old gasoline-based normal. Similarly, aided by their friendly and smart economists, maybe, just maybe, they will be able to provide data and analysis to show that if alternative lower-cost based fuels compete on an even playing field with gasoline and substitute for gasoline in increasing amounts, fuel prices at the pump will likely reflect a new lower-cost based normal favorable to consumers. It’s time to recognize that weakening the oil industry’s monopolistic conditions now governing the fuel market would go a long way toward facilitating competition and lowering prices for both gasoline and alternative fuels. It, along with some certainty concerning the future of the renewable fuels program, would also stimulate investor interest in sorely needed new fuel stations that would facilitate easier consumer access to ethanol.

Who is for an effective Open Fuel Standard Program? People who love America! It’s the American way! Competition, not greed, is good! Given the oil industry’s ability to significantly influence, if not dominate, the fuel market, it isn’t fair (and maybe even legal) for oil companies to legally require franchisees to sell only their brand of gasoline at the pump or to put onerous requirements on the franchisees should they want to add an E85 pump or even an electric charger. It is also not right (or likely legal) for an oil company and or franchisee to put an arbitrarily high price on E85 in order to drive (excuse the pun) consumers to lower priced gasoline?

Although price is the key barrier, now affecting the competition between E85 and E10, it is not the only one. In this context, ethanol’s supply chain participants, including corn growers, and (hopefully soon) natural gas providers, need to review alternate, efficient and cost-effective ways to produce, blend, distribute and sell their product. More integration, cognizant of competitive price points and consistent with present laws and regulations, including environmental laws and regulations, is important.

The ethanol industry and its supporters have done only a fair to middling job of responding to the oil folks and their supporters who claim that E15 will hurt automobile engines and E85 may negatively affect newer FFVs and older internal combustion engines converted to FFVs. Further, their marketing programs and the marketing programs of flex-fuel advocates have not focused clearly on the benefits of ethanol beyond price. Ethanol is not a perfect fuel but, on most public policy scales, it is better than gasoline. It reflects environmental, economic and security benefits, such as reduced pollutants and GHG emissions, reduced dependency on foreign oil and increased job potential. They are worth touting in a well-thought-out, comprehensive marketing initiative, without the need to use hyperbole.

America and Americans have done well when monopolistic conditions in industrial sectors have lessened or have been ended by law or practice (e.g., food, airlines, communication, etc.). If you love America, don’t leave the transportation and fuel sector to the whims and opportunity costing of the oil industry.

For the first time in four years, Los Angeles drivers are paying less than $3 on average for a gallon of gasoline, part of a nationwide free-fall in fuel prices that could provide a substantial boost to the economy.

Because they’re spending less at the pump, Americans are expected to shell out more on holiday gifts, parties and travel this year. Airlines are projected to pass some of their fuel savings along to consumers next year. Businesses with previously hefty fuel bills may find room now to lower prices or increase wages.

Read more at: Los Angeles Times

“It’s a puzzlement,” said the King to Anna in “The King and I,” one of my favorite musicals, particularly when Yul Brynner was the King. It is reasonable to assume, in light of the lack of agreement among experts, that the Chief Economic Adviser to President Obama and the head of the Federal Reserve Bank could well copy the King’s frustrated words when asked by the president to interpret the impact that the fall in oil and gasoline prices has on “weaning the nation from oil” and on the U.S. economy. It certainly is a puzzlement!

What we believe now may not be what we know or think we know in even the near future. In this context, experts are sometimes those who opine about economic measurements the day after they happen. When they make predictions or guesses about the behavior and likely cause and effect relationships about the future economy, past experience suggests they risk significant errors and the loss or downgrading of their reputations. As Walter Cronkite used to say, “And that’s the way it is” and will be (my addition).

So here is the way it is and might be:

1. The GDP grew at a healthy rate of 3.5 percent in the third quarter, related in part to increased government spending (mostly military), the reduction of imports (including oil) and the growth of net exports and a modest increase in consumer spending.

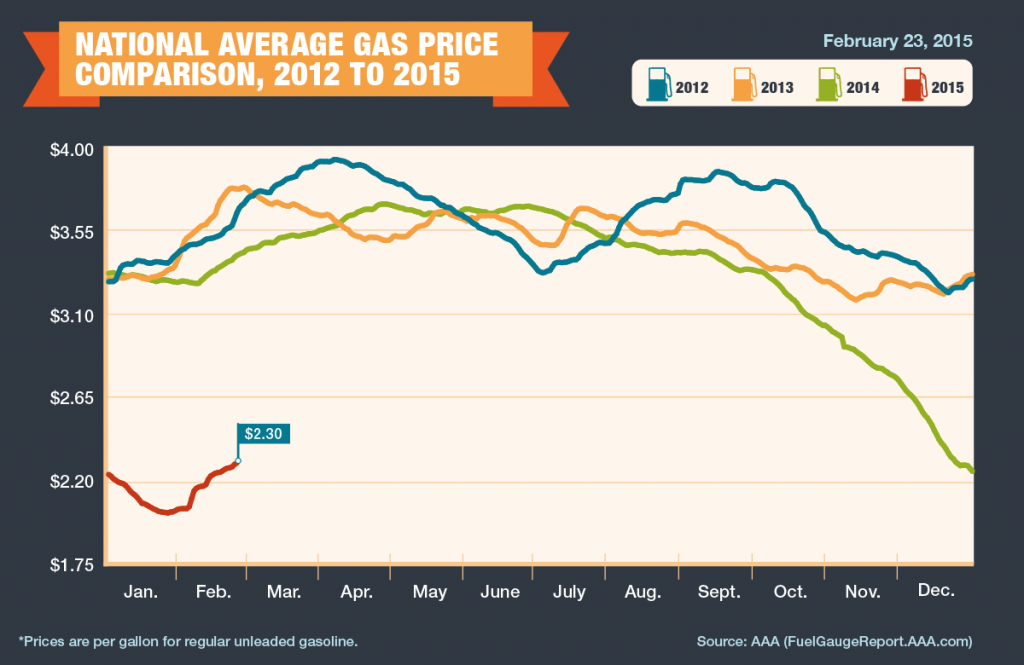

2. Gasoline prices per gallon at the pump and per barrel oil prices have trended downward significantly. Gasoline now hovers just below $3 a gallon, the lowest price in four years. Oil prices average around $80 a barrel, decreasing by near 25 percent since June. The decline in prices of both gasoline and oil reflects the glut of oil worldwide, increased U.S. oil production, falling demand for gasoline and oil, and the likely desire of exporting nations (particularly in the Middle East) to protect global market share.

Okay, what do these numbers add up to? I don’t know precisely and neither do many so-called experts. Some have indicated that oil and gas prices at the pump will continue to fall to well under $80 per barrel, generating a decline in the production of new wells because of an increasingly unfavorable balance between costs of drilling and price of gasoline. They don’t see pressure on the demand side coming soon as EU nations and China’s economies either stagnate or slow down considerably and U.S. economic growth stays below 3 percent annually.

Other experts (do you get a diploma for being an expert?), indicate that gas and oil prices will increase soon. They assume increased tension in the Middle East, the continued friction between the West and Russia, the change of heart of the Saudis as well as OPEC concerning support of policies to limit production (from no support at the present time, to support) and a more robust U.S. economy combined with a relaxation of exports as well as improved consumer demand for gasoline,

Nothing, as the old adage suggests, is certain but death and taxes. Knowledge of economic trends and correlations combined with assumptions concerning cause and effect relationships rarely add up to much beyond clairvoyance with respect to predictions. Even Nostradamus had his problems.

If I had to place a bet I would tilt toward gas and oil prices rising again relatively soon, but it is only a tilt and I wouldn’t put a lot of money on the table. I do believe the Saudis and OPEC will move to put a cap on production and try to increase prices in the relatively near future. They plainly need the revenue. They will risk losing market share. Russia’s oil production will move downward because of lack of drilling materials and capital generated by western sanctions. The U.S. economy has shown resilience and growth…perhaps not as robust as we would like, but growth just the same. While current low gas prices may temporarily impede sales of electric cars and replacement fuels, the future for replacement fuels, such as ethanol, in general looks reasonable, if the gap between gas prices and E85 remains over 20 percent — a percentage that will lead to increased use of E85. Estimates of larger cost differentials between electric cars, natural gas and cellulosic-based ethanol based on technological innovations and gasoline suggest an extremely competitive fuel market with larger market shares allocated to gasoline alternatives. This outcome depends on the weakening or end of monopolistic oil company franchise agreements limiting the sale of replacement fuels, capital investment in blenders and infrastructure and cheaper production and distribution costs for replacement fuels. Competition, if my tilt is correct, will offer lower fuel prices to consumers, and probably lend a degree of stability to fuel markets as well as provide a cleaner environment with less greenhouse gas emissions. It will buy time until renewables provide a significant percentage of in-use automobiles and overall demand.

In the late 1800s, the Studebaker company was the world’s largest manufacturer of wagons and buggies. When the company began making automobiles, they chose to power their engines with electricity, not gasoline. Read more at: Tulsa World

Calling Miss Moneypenny…we need you to get to James Bond quickly. Urgently! According to respected sources, there is a conspiracy in place on the part of the U.S. government and the West to both foster the increased production of shale gas and to drive down demand for gasoline in order to decrease Middle Eastern and Russian oil prices to levels well below production and distribution costs. The effort is aimed at breaking up OPEC, keeping the Saudis in line regarding present levels of production and hurting Russia until it comes to its senses concerning Ukraine. Can you put me in touch with Bond? He could be helpful in determining whether there is manipulation of the market? He’s just the best!

Paranoia has set in on the part of some in the media. The “glut” of oil on the market and low demand has made new drilling an “iffy” thing. The production costs of oil per barrel have not kept pace with revenue from sales. Prices at the pump for gasoline have decreased significantly.

How can we explain the phenomena, except by the presence of manipulation? Indeed, it’s enlightening to see (assumedly) planned, tough, provocative statements from so-called experts that often make headlines followed by weak “No it cannot be true” statements by the same experts to protect their credentials. Being bipolar is, in these instances, seemingly a characteristic.

Thanks to CNBC, here are some summary comments.

Patrick Legland, head of global research at Société Générale, recently said that it was an interesting coincidence that the two events — a drop in oil prices and lower demand — suggests that the U.S. could be deliberately manipulating the market to hurt Russia. Is it lower demand or is the U.S. clearly maneuvering? Legland goes on to indicate lack of in-depth knowledge. Timothy Ash, head of emerging markets research at Standard Bank suggested the U.S. would obviously deny any accusations of manipulation and there is no evidence to suggest that this is the case. “It’s very had to prove. I have heard such suggestions before. It is clearly useful for the West as it adds pressure on Russia” (and, I would add, on OPEC).

Oh, there is more, Jim Rickerts, managing director at Tangent, in a courageous and clear-cut example of ambiguity, stated that manipulation is plausible, although we have no evidence.

Clearly, the manipulation assertions, even though there is little evidence, sell more papers, build a bigger audience for cable news and provide fodder for Twitter and politicians. To the tune of “Politics and Polka,” sing with me, “apparent correlation is not causation, correlation is not causation.”

Oil prices are on a downward spiral, while production and distribution costs are going up in the U.S. and much of the West. It is implausible that the government is behind these trends. Consumer demand is down, even with lower prices at the pump, because of the economy. The government has relatively few tools, except the public and private bully pulpit in the short term, to leverage prices. The current boom in oil shale and resulting surpluses result from decisions made by an extended group of people often years ago — for example, oil companies who recognized that the era of easy-to-drill and cheap oil was coming to an end, speculators who led the market in trumping the benefits in investing long in oil shale and waiting for assumed value to catch up, consumers who seemed to be on a high concerning use of gasoline and technological breakthroughs that made oil from shale seem more amendable to cost benefit calculations.

While there are examples of government manipulating prices of goods (e.g., price controls), most have led to unpredictable and often negative results. The U.S. government, whether controlled by Republicans or Democrats, has not shown itself adept at price setting and manipulation. Nor is it good at keeping things secret — something necessary if it engaged in international manipulation. The New York Times would already have a leaked copy of the strategy and unsigned emails would have been given to the Washington Post. Public discussion of the strategy probably would risk sometimes fake, sometimes real approbation-depending who gets hurt or will get hurt. The U.S. would face copycats, as they have in the past, like the Saudis and OPEC and, maybe someday, Russia. They would say, “well, if the U.S. can do it, why can’t we?” The U.S. would calmly respond, No we are not manipulating oil markets. You give us too much credit and assume to many skills. Also, remember, the U.S and the oil companies believe in free markets. Don’t they? Well maybe, but clearly, not all the time with respect to the government and almost none of the time with respect to the oil companies? (Try getting replacement fuels at the pump of an oil-company franchised “gas” station.)

Okay, Miss Moneypenny, I changed my mind. We don’t need James Bond nor do we want to pay for the Bond girls. (Besides, the last Bond looked like President Putin when his shirt was unbuttoned and Sean Connery is on Medicare.) What we need is prayer and penitence for the experts for travailing in rumors. It is not terribly helpful when trying to sort out complicated issues related to oil prices and demand. If the government is somehow manipulating the market, many, even very pro-market advocates, will give it credit for a strategy that, should it be successful, might limit Russia’s desires concerning Ukraine and OPEC’s efforts at price fixing in the past. While the word has an evil sound, perhaps legitimately, manipulation would likely be judged better than war. But before credit is offered, look at the data and well-reviewed studies. Don’t fret, there is very little evidence that government manipulation has occurred in the recent past or is occurring at the present time.

Things have always been a little easier in Europe when it comes to saving gas and adopting different kinds of vehicles. The distances are shorter, the roads narrower, and the cities built more for the 19th century than the 21st.

Europeans also have very few oil and gas resources, and have long paid gas taxes that would make Americans shudder. Three to four times what we pay in America is the norm in Europe.

Thus, Europeans have always been famous for their small, fuel-sipping cars. Renault was long famous for its Le Cheval (the horse), an-all grey bag of bones that’s barely powerful enough to shuttle people around Paris. The Citroën, Volkswagen and Audi were all developed in Europe. Ford and GM also produced models that were much smaller than their American counterparts. Gas mileage was fantastic — sometimes reaching the mid-40s. A big American car getting 15 miles per gallon and trying to negotiate the streets of Berlin or Madrid often looked like a river barge that had wandered off course.

More Europeans also opt for diesel engines instead of conventional gasoline — 40 percent by the latest count. The overall energy conversion in a diesel engine is over 50 percent and can cut fuel consumption by 40 percent. But diesel fuel is still a fossil fuel, which have a lot of pollution problems and don’t really offer a long-range solution. So, Europeans decided that it’s time to move on to the next generation.

Last week the European Union laid down new rules that will try to promote the implementation of all kinds of alternative means of transportation, making it easier for car buyers to switch to alternative fuels. The goal is to achieve 10 percent alternative vehicles by 2025 over a wide range of technologies, removing the impediments that are currently slowing the adoption of alternatives. If everything works out, tooling around Paris in an electric vehicle within a few years without suffering the slightest range anxiety would become a reality.

By the end of 2015, each of Europe’s 28 member states will be asked to build at least one recharging point per 10 electric vehicles. Since the U.K. is planning to have 1.55 million electric vehicles. That would require at least 155,000 recharging stations, which is a pretty tall order. But members of the commission are confident it can be done. “We can always call on Elon Musk,” said one official.

For compressed natural gas, the goal is to have one refueling station located every 150 kilometers (93 miles). This gives CNG a comfortable margin for range. With liquefied petroleum (LPG) it will be for one refueling station every 400 kilometers (248 miles). These stations can be further apart because they will mainly be used by long-haul trucks travelling the TEN-T Network, a network of road, water and rail transportation that the Europeans have been working on since 2006.

Interestingly, hydrogen refueling doesn’t get much attention beyond a sufficient number of stations for states that are trying to develop them. There is noticeably less enthusiasm for hydrogen-powered vehicles than is expressed for EVs and gas-powered vehicles. All this indicates how the hydrogen car has become a Japanese trend while not arousing much interest in either Europe or America.

At the same time, Europeans are planning very little in the way of ethanol and other biofuels (they also mandate 20 percent ethanol in fuel). Sweden is very advanced when it comes to flex-fuel cars. They have been getting notably nervous about the misconception that biofuels are competing with food resources around the world — Europe does not have its own land resources to grow corn or sugarcane the way it is being done in the United States and Brazil. Europe imports some ethanol from America but it is also now developing large sugar-cane-to-ethanol areas in West Africa.

Siim Kallas, vice president of the European Commission for TEN-T, told the press the new rules are designed to build up a critical mass of in order to whet investor appetites for these new markets. “Alternative fuels are key to improving the security of energy supply, reducing the impact of transport on the environment and boosting EU competitiveness,” he told Business Week. “With these new rules, the EU provides long-awaited legal certainty for companies to start investing, and the possibility for economies of scale.”

Is there any chance that the public is going to take an interest in all this? Well, one poll in Britain found last week that 65 percent would consider buying an alternative fuel car and 19 percent might do it within the next two years. Within a few years they find the infrastructure ready to meet their needs.

Israel has more patents per capita than any other nation in the world. Despite wars and tension at its borders, international investor interest remains high, particularly in high-tech industries. Indeed, high-tech industries continue to grow faster than any other industrial sector.

Okay. I have a serious question for questioning minds. The Jerusalem Post stated that pollution levels dropped by 99 percent on Saturday, Yom Kippur, a key Jewish religious holiday. The article indicated that nitrogen oxides decreased by 99 percent in the Gush Dan and Jerusalem regions and that other serious pollutants that affect health and well-being also dropped significantly. (Truth in advertising compels me to say that Israel has another holiday called Lag B’omer, where folks light bonfires to celebrate a wise sage in Israel’s past. Many also travel to the sage’s tomb. Both activities make air quality terrible. But understanding, apology, patience and penitence may result yet in friendlier environmental options.)

Wow, could Israel patent environmental behavior based in religion to secure a healthy environment? What would they patent? Perhaps, activities resulting from seeking forgiveness for previous driving and fuel related sins generating harmful pollutants. Asking forgiveness and apologizing are what Jews are supposed to do on the Holy Day. Or should they try patenting the environmental God, Himself or Herself, to make sure we have a major partner with respect to minimizing pollution in the environment. Here, they could include other possible partners like the scientists busy at work in Switzerland on the “God particle” in their patent.

Maybe Israel’s success with Yom Kippur behavior would lead Catholics, Protestants, Muslims, Hindus and Mormons to define and patent Holy No Drive Days or better yet, because of lessons learned from Israel and possible Israeli involvement, lengthier environmental behavior days, weeks, months or years. Because of the negative impact on the global economy, international security and the environment of the world’s present dependency on oil and oil’s derivative gasoline, perhaps all the major religions and even the minor ones could agree on a range of environmentally friendly behavior changing initiatives, particularly related to one of the largest pollutants of them all…oil. Each patent would be based on prescriptions written or derived from religious interpretation of each religion’s environmental norms and tenants and holidays. Here’s one: Just say no to gasoline and yes to use of replacement fuels. Tithings from believers or congregants would support the effort. Figure it out, enough long holidays and the world might begin to reduce levels of pollution and likely GHG emissions, as well as oil-based wars and tension. Maybe we could develop a whole set of religious patents, that once patented, would be capable of being used by any nation or religion and any group or individual free. You know, building good, Godly behavior.

No government subsidies, no new government regulations. If behavioral changes stick, based on religious initiatives, our grandchildren and their grandchildren could live in a better world. While, likely impossible and the idea of patenting good behavior is more humorous than real, the thought seems worthy of a prayer or two and lots of meaningful sermons as well as interfaith action.

Collaboration by churches, synagogues and mosques could influence governments to jump in and also play a leadership role. Clearly, religiously inspired guilt is often aspirational and motivational — sometimes politically. Combined with religiously inspired individual commitment concerning grassroots activity, it could secure secular support for the development and implementation of comprehensive fuel policies concerning environmental, security and economic objectives — like social justice.

Where might we go with this? Probably not very far. But think of it. We spend much time arguing about God, and often much less time achieving godliness through reforming institutional and our behaviors as good stewards of the world. If we could marshal (excuse the pun), the leaders of some of the major religions of the world to help reduce harmful pollution from gasoline, GHG emissions and wars related to oil, over time, amendments to individual and group activities could help “convert” the bleak forecasts concerning climate change and increasingly dirty air for the better. Additionally, such an effort could also lead to a reduction of tension in areas like the Middle East, and global and national economic growth based on the development and distribution of both transitional replacement and renewable fuels.

I don’t expect invitations to discuss the matter from religious forums or meetings. But seeking collaboration from the religious community to end dependence on oil is something to think about in terms of the “what ifs.” Maybe in this context, a respected celebrated religious leader like Pope Francis could be asked to try to bring together religious leaders and even some secular ones to at least begin to discuss initiatives across man- or women-made national boundaries.

The proposed agenda would link short-term coordinated strategies to use transitional replacement fuels such as natural gas, ethanol, methanol and biofuels with longer-term plans (with immediate efforts) to increase the competitiveness of electric and hydro fuels. For my religious colleagues and secular friends, it seems to me that beginning these discussions is a moral and practical imperative.

When he died, the patriot Paul Revere was embalmed in V8 juice, tanning lotion and several energy drinks. Surprisingly, he reappeared at a relatively recent conference of the Massachusetts Association of Automobile Dealers, looking fit and ready for another ride. The dealers had prayed for his second coming. They hoped that even though his previous ride was only one horsepower, he would consent to try a low-horsepower vehicle and ride the state, warning their brave residents that Tesla is online and in-store sales of electric cars coming. The dealers’ marketing folks felt that a reincarnated Revere would do wonders for their shaky image as wheeler dealers (excuse the pun). His deep, holier-than-thou, Fred Thomas-type voice (you know, the actor-turned-politician-turned-actor who now sells most anything on TV for money) would convince all but his former peer group (dead people) that Tesla was anti-American.

“What did Tesla do wrong,” asked Revere? Oh, it’s trying to sell its non-horse, torque-engine vehicles directly to modern-day patriots. Can you imagine euthanizing horsepower? Tears came to Revere’s eyes. But there’s more, paraphrasing a former automaker and cabinet officer Charles Wilson, one of the dealers indicates that what’s good for automobile dealers was and will always be good for America. What Elon Musk, the head of Tesla Motors, wants to do is eliminate dealerships. If the present case before the courts in Massachusetts is won by Tesla and Teslas are sold online, from a storefront, or shopping mall, surely Ford, Chrysler and General Motors will not be far behind. Forget capitalism, forget free markets, forget competition, even forget, Paul, your membership in the old Tea Party in Boston (you know, the taxation-without-representation crowd). Forget everything you fought for. By eliminating dealerships, Tesla will cost jobs. Dealers soon will have to close their doors. Bypassing dealers to sell cars will also first limit and then end our community philanthropy — you know, Little League teams, Fourth of July concerts, community picnics, jerseys for kids etc. Tesla’s headquarters is in California, and it’s a crazy state with Hollywood and all that. Californians act like foreigners. Tesla’s founder believes in global warming, he isn’t satisfied with life in America and he is developing a spaceship where the elite can, someday soon, travel to a second home and ruin our local economy. Losing dealers will make every community less American. Sure, vehicle costs may come down and emissions may improve, but what American is unwilling to pay extra to save his or her friendly auto dealer?

Revere was puzzled. He was a merchant way back then and he believed that competition and the free market were part of the American Dream. (To be honest, he also feared riding and did not understand how he could ride a multiple-horse powered vehicle. He had only mounted one horse.)

But he understood what the dealership folks were trying to tell and sell him. While in his heart, he was a bit ambivalent, he finally said he would do the famous ride again, and this time, because mileage capacity had increased and population of Massachusetts had grown, he agreed to try to go farther west than in his famous, poet-legitimized and sanctified ride.

But just as he gave them the okay, the dealerships received an email from a colleague in Boston that Tesla had won in the Massachusetts court. One dealer started crying. Several others criticized “those activist judges.”

Revere asked to read the email. It indicated that the Massachusetts Supreme Judicial Court unanimously determined that the Mass. State Automobile Dealers “lacked standing to block direct Tesla sales under a state law designated to protect franchises owners from abuses by car manufacturers” (Reuters, Sept. 15, 2014). Succinctly, the law was tied to the franchise relationship rather than unaffiliated manufacturers like Tesla.

The court’s finding should make it easier for Tesla to secure positive rulings in many other states. Earlier this spring, senior officials from the Federal Trade Commission strongly indicated that laws outlawing direct sales harmed consumers. Revere, after looking at the email, felt guilty that he had all but agreed to replicate his famous ride. But he was consoled by the fact that freedom and competition won out, at least in the Tesla case in Massachusetts, and that at least consumer democracy was alive and well in the state. He couldn’t help but muse on the fact that Texas, a state supposedly committed to minimal regulation and almost zero interference by government concerning businesses and citizens’ lives, turned its back on Tesla because of lobbying by dealers. Tesla cannot sell directly in Texas. But, as Ralph Waldo Emerson suggested, “foolish consistency is the hobgoblin of little minds.” After driving a Tesla (with no horsepower), Revere went back to the halo- lit neter lands happy. We haven’t heard from him since. But on faith alone, his experience with reincarnation likely would have made him a fan of Tesla’s electric cars and other alternative fuels.