Thanks for the gift, OPEC. Can we keep it?

Ever since oil prices, and with them gasoline prices, began plummeting last fall, the trend has been portrayed in varying forms as a “gift” or an “early holiday present” or a “tax rebate” for consumers, who are expected to give thanks for this free stuff.

The windfall is indeed significant: Last December, Stephen Stanley, the chief economist at the securities firm Amherst Pierpont, told CNN Money that every time gasoline drops a penny, consumers pocket a cool $1 billion.

Based on that math, drivers must be getting dizzy, counting up all those pennies saved and pennies given back. It’s true that the average national price for regular 87-octane gasoline was $2.18 on Friday, down from $3.01 a year ago, according to AAA’s Daily Fuel Gauge Report.

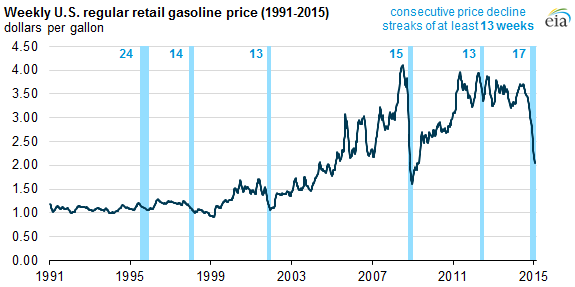

But look at this graph from the U.S. Energy Information Administration, which puts today’s “low” prices in context:

See the left side, where the line runs as flat as the Kansas landscape? That’s the retail price from 1991 to about 2002, when gas was around a buck a gallon. The price we’re paying today is actually higher than during the last “plunge” in prices, during the peak of the recession in 2009.

The latest self-serving proclamation that consumers should appreciate how good they have it with oil comes from Ali Al Mansoori, the head of economic development for Abu Dhabi, one of the seven territories that make up the OPEC member United Arab Emirates. Bloomberg Business Week reports:

“It is a gift to the world that oil has dropped to $50,” Al Mansoori said. “Would we like for oil to stay at $50? Absolutely not. We would like oil to go to $70, $80, but beyond that I think it would hurt the economic growth.”

Notice the language: “We would like” oil to go higher. Much higher. Think that OPEC can’t make that happen at its leisure, with a slight cut in production?

We get obsessed about the day-to-day price of oil, but as long as it’s virtually the only choice for transportation fuel for the vast majority of drivers, and as long as we must import about half the 18 million barrels a day the U.S. consumes, how the price is set will be beyond our control.

And since U.S. crude production is falling — the rig count fell by 12 this week and is now at its lowest level since April 2002 — prices could rise just as quickly as they’ve fallen. We’re not in the oil-prediction game, but a guy whose opinion we trust, former Shell Oil president John Hofmeister, keeps saying that we can’t escape the rollercoaster of the oil market until we get serious about pursuing alternatives.

Here’s what he said in an interview with Bloomberg on Friday:

“The world needs 92, 93 million barrels of oil a day. That hasn’t changed … we all may walk around wearing neck braces as the price snaps back into where it once was in high levels. I think we’re going to see high prices for a sustained period once again, until we realize that we should create a competitor for oil products in transportation fuels, like natural gas. Natural gas should be a natural inclination, to get away from this volatility of oil. But we have to make the change sometime, because volatility is killing the industry.”

Consumers don’t want gifts that might be revoked a short time later. They want a stable, reliable, low price at the pump. Fuel choice is the only way to make it happen.

Related posts:

- Angry about gas prices? Do something

- Wait, oil companies don’t like high prices?

- SoCal drivers rage, but they do have a choice

- Oil is cheap, so why is it sky-high in places?

- Pearson proves there’s demand for E85